ANZ Express Payments is our payment solution that processes eligible international payments into Australia in real-time, 7 days a week, 24/7.disclaimer

Payments are routed via Australia’s real-time payments network, the New Payments Platform (NPP), which is available for processing after RTGS cut-off times and on weekends.

ANZ is proud to be the first major Australian bank to process eligible cross-border payments via the NPP.

And the best part?

We have enabled ANZ Express Payments for all our AUD Clearing customers, because real-time clearing isn’t an add on, it’s built into our standard offering. No extra fees. No extra integration.

Speed and availability

- Typical settlement times of under 60 seconds when routed via the NPP, which is available for processing 24/7 i.e. after RTGS cut-off times and on weekends.disclaimer

Cost-effective

- No extra fees. No extra integration.

Smart

- Eligible payments are routed via NPP, and non-eligible payments are automatically defaulted to RTGS.disclaimer

Scalable

- No changes to your existing banking channels or agreements with ANZ. Future releases will support growing payment volumes and currencies.

Our objective is simple: clear payments into Australia in real-time using NPP.

Why? To help people get their money when they need it, anytime, from anywhere.

We remove the hassle, so you can focus on delivering a seamless international payment experience for your clients.

Talk to our team to learn more about how you can take advantage of ANZ Express Payments.

- ANZ is a founding shareholder of New Payments Platform Australia Limited and a direct participant in the NPP.

- ANZ has activated ANZ Express Payments for all our AUD clearing customers.

- Over 6 million retail customers and numerous corporates already benefit from NPP.

- ANZ is the #1 provider of AUD Bank-to-Bank Clearing Services for the 16th consecutive year, according to FImetrix.

- Dedicated teams offer global coverage and expertise for Clearing customers.

- ANZ Clearing customer sends a payment using BSB and account number via their usual banking channel.

- ANZ checks if the recipient is NPP-enabled. If NPP-enabled, ANZ attempts to process the payment using the NPP. If not, the payment defaults to RTGS.disclaimer

- For NPP-processing, payments need to meet the eligibility criteria (see below).

- No infrastructure changes are required by the sender.

- No cut-off times when processed via NPP, payments can be processed outside traditional RTGS hours.

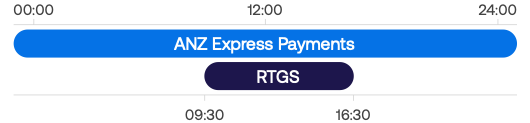

ANZ Express Payments vs RTGS processing windows

- Typically, we observe cross-border payments being settled and processed in under 60 seconds when routed via NPP.disclaimer

- If a payment fails to process via the NPP, payments will be re-routed via Australia’s domestic high-value clearing stream (RTGS), rather than rejecting the payment.disclaimer

To be eligible for ANZ Express Payments, the payment must:

- Straight-Through Process. This requires that:

- The SWIFT instruction is correctly formatted to meet ANZ’s STP requirements. Refer to ANZ's STP format guide.

- Correct details are quoted including BSB and Account Number.

- The payment details have no anti-money laundering (AML), counter terrorism financing (CTF) or sanctions-related issues.

- The SWIFT instruction is correctly formatted to meet ANZ’s STP requirements. Refer to ANZ's STP format guide.

- Not exceed applicable value limits.

- Be payable to an account that is NPP-eligible.

- Be in Australian Dollars (AUD).

- Be fully funded at a group level (depending on limits).

- Be an individual MT103 or pacs.008 message.

- Not be future dated.

From aerospace to zinc

and just about everything in between

ANZ Institutional supports customers across a wide range of industries operating domestically or moving goods and capital across Asia-Pacific and beyond.

Speak to us about ANZ Express Payments

If you're an existing customer

speak to your ANZ Relationship Manager

or Account Manager

View our full set of relevant disclosures.

ANZ Express Payments are processed subject to ANZ’s terms and conditions and eligibility criteria.

Payments processed in real time are typically cleared within 60 seconds of receipt by ANZ. ANZ processes NPP payments 24/7, 365 days a year. Payments may be subject to security screening or service disruptions (including by the recipient bank) which may impact processing times and availability.

ReturnPayments re-routed via RTGS will be subject to RTGS standard processing hours. For further information, see Clearing services.

Return