ANZ's Non-Operating Holding Company

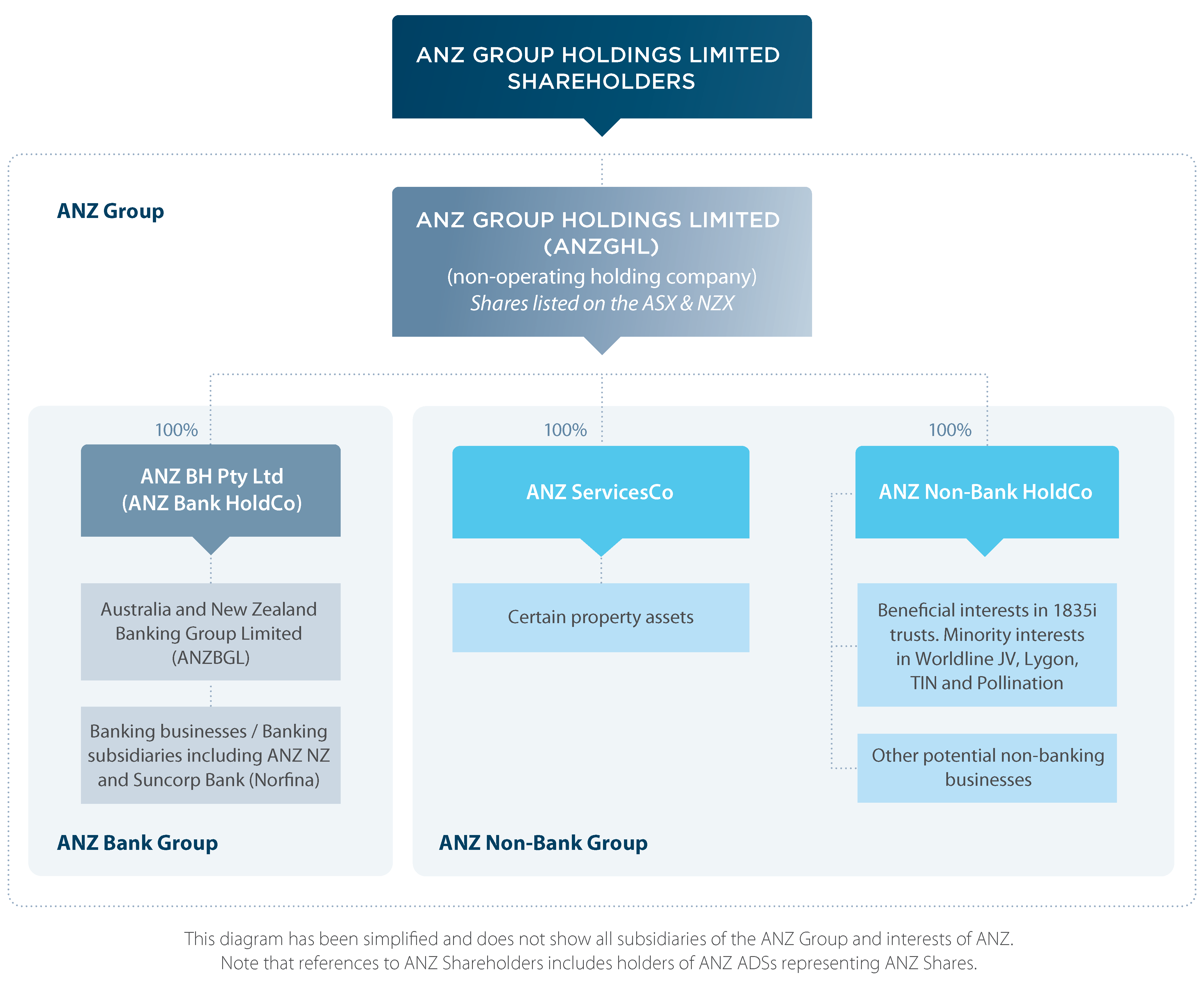

ANZ Group Holdings Limited is an authorised non-operating holding company under the Australian Banking Act.

On 3 January 2023, ANZ implemented a scheme of arrangement to establish ANZ Group Holdings Limited (ANZGHL), a non-operating holding company (NOHC) as the new listed parent company of the ANZ group.

The restructure of ANZ Group is an internal re-organisation of ANZ under which:

- ANZ Group Holdings Limited is the new listed parent company of the ANZ Group in place of Australia and New Zealand Banking Group Limited (ANZBGL);

- ANZ’s banking and certain non-banking businesses are separated into two groups, the ANZ Bank Group and ANZ Non-Bank Group; and

- ANZ ServiceCo is established as an internal service company

The restructure of the ANZ Group involved ANZ shareholders exchanging their existing ANZ shares for shares in ANGHL, which commenced normal trading on the ASX and NZX on 4 January 2023.

ANZ Group Holdings Limited - is a non-operating holding company that owns or controls other companies but does not carry on an operating business itself

ANZ Bank Group – will hold all of ANZ’s:

- banking businesses (including ANZBGL and ANZ NZ);

- international regulated bank operations; and

- insurance businesses (including ANZ Lenders Mortgage Insurance and ANZ Cover)

ANZ Non-Bank Group - will hold certain non-banking businesses

- The ANZ Board expects it to be used as a vehicle for innovation and growth in certain non-banking businesses (including banking-adjacent businesses) that ANZ may develop or acquire

- This will help bring new technology and non-bank services to ANZ customers

ANZ ServiceCo – is an internal service company to hold certain property interests and, in the future, to potentially provide certain central shared service functions across the ANZ Group.

ANZ Group & ANZ Banking Group boards

| ANZGHL | ANZ BH Pty Ltd | ANZBGL |

|---|---|---|

| Paul O'Sullivan (Chairman) | Paul O'Sullivan (Chairman) | Paul O'Sullivan (Chairman) |

| Shayne Elliott (CEO) | Shayne Elliott (CEO) | Shayne Elliott (CEO) |

| Richard Gibb | Richard Gibb | Richard Gibb |

| Scott St John | Scott St John | Scott St John |

| Jane Halton AO PSM | Jane Halton AO PSM | Jane Halton AO PSM |

| Holly Kramer | Holly Kramer | Holly Kramer |

| Christine O'Reilly | Christine O'Reilly | Christine O'Reilly |

| Jeff Smith | Jeff Smith | Jeff Smith |

| John Cincotta# | John Cincotta# | |

| Graham Hodges# | Graham Hodges# | |

For individual bios of the Directors click here

#As part of the NOHC restructure, ANZ agreed to appoint an additional Non-Executive Director to the two ANZ Banking Group boards (ANZ BH Pty Ltd & ANZBGL), being the entities at the head of the ANZ Banking Group, who is not also a director of the NOHC (ANZ Group Holdings Limited) or the ANZ Non-Banking Group (Banking Group Director). Mr Hodges was appointed in February 2023 to fill that role and Mr Cincotta was appointed as an additional Banking Group Director in February 2024. For individual bios of the Banking Group Directors, click on the following links: Graham Hodges and John Cincotta .

ANZ Non Bank Group interest

INVESTMENT |

DESCRIPTION |

ANZ NON-BANK |

|---|---|---|

1835i trusts |

Economic interest in start-up businesses which support or are involved in the developmentof technology and related services in the financial services industry. Interests of varying sizes in these businesses are held by the 1835i trusts in which ANZ has a 100% beneficial interest. |

100% economic interest in |

Worldline |

Minority stake in the merchant acquiring business ANZ Worldline Payment Solutions. |

49% |

Pollination |

Pollination provides advisory services, project investment, and asset management for corporations accelerating their transition to net-zero |

~12% |

Lygon |

Lygon is a private blockchain platform which allows customers to request, track and exchange bank gurantees all from the one portal. |

25% |

Trade Information |

TIN is a trade data registry, which enables the collation and exchange of original trade supply data between buyers, suppliers and financiers around the globe. |

16.7% |

5 As disclosed in ‘Proposed restructure of the ANZ Group to establish a non-operating holding company explanatory memorandum’

ANZ's non-operating holding company additional information

The Scheme of Arrangement to establish a non-operating holding company voted on at the 2022 Scheme Meeting was implemented on 3 January 2023

You may find the FAQ section of the 2022 Explanatory Memorandum (Scheme Booklet) helpful (document available under the 'documents' section on this page).

Eligible ANZ shareholders received one ANZ NOHC share for each ANZ share they held. Transitional activities that took place included:

- ANZ shares suspended from trading on the ASX and NZX at close of trading on 20 December 2022

- ANZ Group Holdings Limited (ANZ NOHC) shares commenced trading on the ASX on a deferred settlement basis on 21 December 2022.

- ANZ NOHC shares entered into a trading halt on the NZX on 21 December 2022.

- ANZ regulatory capital securities (including ANZ’s hybrid securities) quoted for trading on the ASX commenced trading under their new ASX codes on a deferred settlement basis on 21 December 2022

- Eligible ANZ shareholders received ANZ NOHC shares on the implementation date of 3 January 2023

- Normal trading of ANZ NOHC shares on the ASX (ASX: ANZ) and NZX (NZX: ANZ) commenced on 4 January 2023.

In May 2022, ANZ announced its intention to lodge a formal application to establish a non-operating holding company and create distinct banking and non-banking groups within the organisation to assist ANZ to better deliver its strategy to strengthen and grow its core business further.

This proposal was subsequently approved by Australian banking regulator the Australian Prudential Regulatory Authority, the New Zealand banking regulator Reserve Bank of New Zealand, the Australian Federal Treasurer, ANZ shareholders and the Federal Court of Australia.

This structure is consistent with how many financial institutions around the world are structured and will provide ANZ with greater flexibility and the potential to create additional value for shareholders over time. There will be no impact on customers and no change to how ANZ’s existing banking operations are regulated.

Please contact the ANZ Share Registry or visit ASX Announcements for further information.