External operating environment

The New Zealand economy remains sound with commodity prices remaining solid, population growth still strong and continued low unemployment.

GDP growth, however, has slowed. Business and consumer confidence is down due to uncertainty in the international economic outlook. This has resulted in lower business investment and consumer spending. That has meant the historically low official cash rate environment has not provided the economic stimulus many had hoped for.

The level of regulatory scrutiny is increasing on all financial services entities in New Zealand and this is increasing compliance costs for the business.

The proposed RBNZ capital changes – which are intended to create a stronger and more robust banking industry and are expected to be made public in December 2019.

Business strategy outcomes

We continued to progress our strategy of simplifying the business and improving customer experience.

The OnePath Life insurance business sale was completed in November 2018, as well as other non-core ANZ New Zealand assets Paymark and ANZ Securities.

Frontline sales incentives were removed in 2019 to give confidence to customers that any products and services they purchased were sold to them for the right reasons.

In striving to be the best bank to help Kiwis own homes, we developed a market leading proposition that includes a “healthy homes” package to better insulate and heat houses.

The Commercial and Agri, and Institutional parts of ANZ New Zealand had a major focus on environmental initiatives to assist customers in the economy.

Within the Wealth unit, superannuation product Kiwisaver continued its strong growth, surpassing $14.5 billion in funds under management.

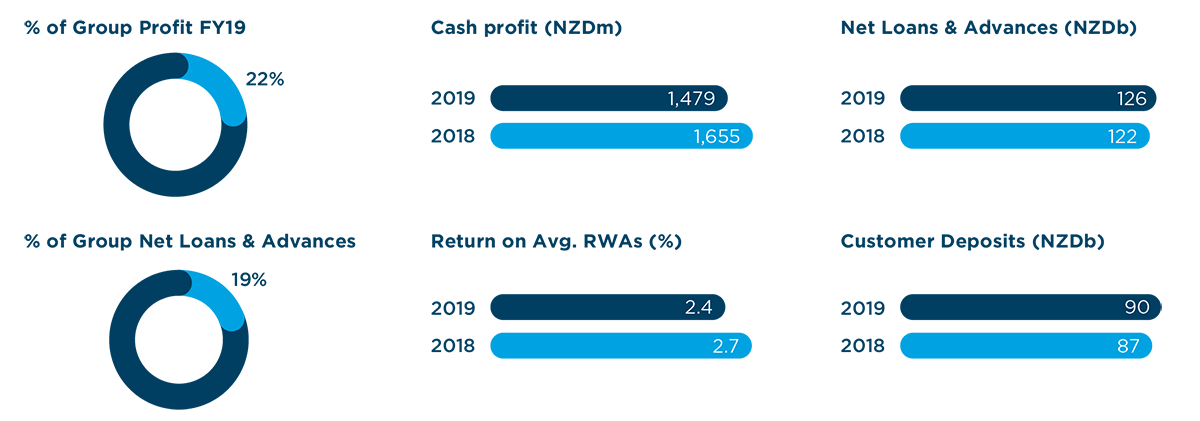

Performance

Our New Zealand business maintained a leading position in core banking products this year, with ~31% share of mortgages (August 2019), ~34% share of household deposits (August 2019) and ~24% share of KiwiSaver (June 2019).

While the operating conditions were more challenging, Retail and Commercial both delivered balance sheet growth in 2019. Retail net loans and advances were up

4% (driven by Home Loan growth), and Commercial lending up 2%. Revenue for the division was however impacted by margin pressure from lower deposit margins and home loan mix changes.

Customer deposits grew 3% and customer numbers grew modestly to 2.4 million, of which 1.5 million customers are digitally active. Digital sales were up ~4% and now account for ~ 30% of all retail sales.

Focus in recent years on more conservative lending standards, together with a benign credit environment, contributed to provision charges remaining low this year.

Financial Performance for New Zealand is provided within the Our Performance section on pages 52 to 65.