We seek to treat our customers fairly and responsibly, providing them with suitable and appropriate products and services, supported by strong data protection.

We have identified three customer segments where we believe we can best achieve this: home owners, business owners and companies that move capital and goods across the region.

Support for first home buyers

Our research shows that 64 percent of first home buyers are uncertain of what to do when it comes to buying their first property and they want someone they can trust to guide them through the process.1 In response, we are improving the skills of our frontline staff enabling them to provide tailored guidance and support to first home buyers. We have:

- provided more than 3,300 frontline staff with Home Loan Coach training across Australia and New Zealand;

- improved our First Home Coach training in Australia – nearly 800 of our frontline staff have completed this training; and

- provided Construction Coach training in New Zealand to support customers building or renovating a home – more than 220 frontline staff have received training.

We have also developed the most accurate property price predictor in the market to support customers in establishing the value of their future home.

In recognition of our commitment to this customer segment ANZ has been named Bank of The Year for First Home Buyers by Canstar for three years running (2017–2019).

Industry insights

During the year we have undertaken significant engagement with industry stakeholders to ensure that as an organisation we are directly linked to the housing policy agenda, offering market expertise to support government, customers and the community with relevant insights to inform decision-making.

We have entered into a three-year partnership with CoreLogic to deliver a bi-annual housing affordability report. The report provides in-depth market analysis of the Australian housing market for both buyers and renters.

Links to 2019 Group

Performance Framework

We are committed to improving the customer experience, as highlighted by the implementation of 16 initiatives in Australia in response to the Royal Commission. There were some challenges during the year including technology stability issues, and a period of underperformance in respect of assessment and approval times relative to peers in home lending. Institutional performance in key customer satisfaction/relationship strength surveys continued to be a highlight, along with strong digital engagement with customers.

Refer to our Remuneration Report

Making homes healthier in New Zealand

According to research by the Building Research Association of New Zealand, about half of the homes built are unsuitable for the climate – they are not adequately insulated, have insufficient heating and are damp with visible signs of mould.

“As New Zealand’s biggest home lender, housing is one area where we want to make a difference”, says Antonia Watson, Acting Chief Executive Officer, New Zealand.

We have set aside NZ$100 million so our customers can enjoy warmer, healthier homes while potentially also keeping energy costs down. Last year we began offering our home loan customers (both owner-occupiers and investors) an interest- free home loan top-up (up to NZ$5,000). More than 1,800 interest-free home loans (to the value of NZ$6.3 million) have been drawn down as at 30 September 2019. The top-up offer was also extended to heat pumps in July 2019.

In addition, in April 2019 we launched a Healthy Home Loan Package, that includes discounts to standard home loan rates, as well as fee waivers across a range of accounts, for customers buying, building or renovating a home to 6 Homestar or above, in New Zealand.

Thirty four customers are now on the package (funds under management of NZ$11.7 million) and we are working to identify existing eligible customers to transition them across to the package.

Not only are there health benefits associated with more energy efficient homes but occupants may also have more disposable income because they are paying lower power bills.

“When every dollar counts, a lower home loan rate might swing the decision to go the extra mile on health and sustainability measures.” says Antonia.

Customer remediation

Fair, responsible and efficient customer remediation is a focus for the bank, with significant investment being made across our Australia, Wealth and New Zealand Divisions.

We are currently resolving identified fee or interest discrepancies with over 3.4 million Retail and Commercial customers. To date our Australian Retail and Commercial Responsible Banking team has remediated over one million customer accounts5 and issued refunds of around $62 million.

In Wealth, the team has completed the first stage of a review to identify instances of inappropriate advice to customers. Over 7,000 advice cases, spanning more than a decade, were reviewed. In addition, the majority of remediation cases relating to ANZ Financial Planning ‘fee for no service’ have now been remediated.

Wealth has remediated nearly 26,000 cases in total and made payments of $95.2m as at 30 September 2019.

Over the 12 months to 30 September 2019, the Responsible Banking team has increased the number of dedicated remediation resources working on large scale customer remediation matters from around 150 to around 275 people.

Similarly, the team within Wealth has expanded from around 120 to around 170 over the same time period and is projected to increase to around 200 by December 2019. Our New Zealand business also has almost 60 dedicated remediation resources. These additional resources, together with an increase in infrastructure and capability, are enabling us to refund impacted customers in a scalable and repeatable way.

More than 500 people throughout the Australian Retail and Commercial business are also working on a number of smaller customer remediations, fixes and investigations.

We are delivering an ongoing education program to share ‘lessons learnt’ and to highlight the impacts on customers when we fail to get it right. In creating a collective understanding of the root causes of our existing remediations, we continue to build a shared accountability for the prevention of future issues.

Customer experience

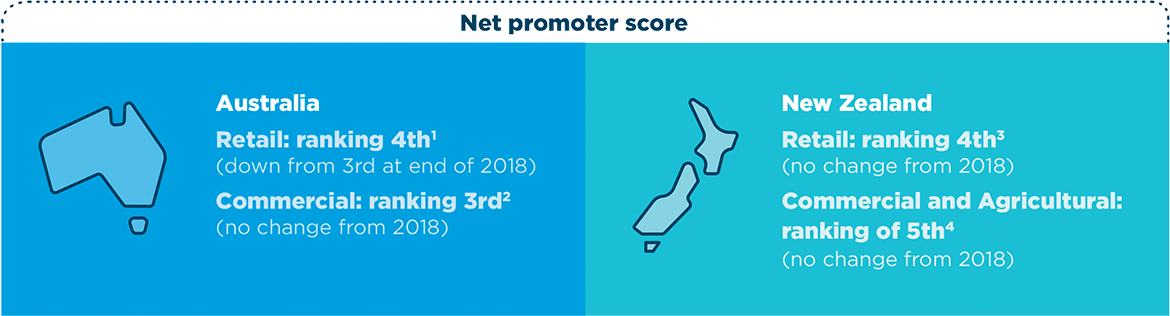

One way in which we measure the experience of our customers is through Net Promoter Score. Net Promotor Score enables us to gauge whether we are meeting customer needs and expectations and how we are performing relative to peers. It is measured by asking customers how likely they are to recommend ANZ (on a 0–10 scale) and is calculated by subtracting the percentage of detractors (those who give a score of 0–6) from the percentage of promoters (those who give a 9 or 10).

With respect to our Australian and New Zealand Retail and Commercial customers we failed to meet our target to improve our Net Promoter Score relative to peers. Our Institutional ranking remains at number one in both Australia and New Zealand.

Managing customer complaints

Listening to our customers and responding to their complaints in a timely, transparent and fair way is key to maintaining their confidence and trust in us.

This year, both the Australian Financial Complaints Authority and the Australian Securities and Investments Commission identified the need for significant improvement in our internal dispute resolution. High complaint volumes and lengthy delays in resolution were highlighted. We have established a detailed action plan which sets out the changes we need to make to improve our customers’ experience and we will keep stakeholders informed of our progress.

For further information on our approach to complaints handling, complaint volumes and the role of our Customer Advocate refer to our 2019 ESG Supplement available at anz.com/cs in December.

Offering customers more convenient and engaging banking solutions

Fifteen years ago more than half of all banking transactions occurred within the branch network; today, that number is down to less than 10 percent. Of the 2.8 million customers using our ANZ app, 36 percent are using mobile banking only – up 30 percent this year, demonstrating the significant shift in how customers are choosing to engage with us.

This digital banking evolution brings both opportunities and challenges for ANZ. We are tailoring our products and services to the changing habits of our customers, who have told us they want more flexibility in their banking. Our digital technology now makes it possible for our customers to serve themselves, anywhere, anytime and we are adapting the way we operate to accommodate this. Peak usage on the ANZ app is between 4–6pm, and even during our quietest time between 12–2am we are serving almost 100,000 customers.

The benefits of open banking

Open banking regulation came into force at the start of July in Australia, supporting the sharing of generic product data with third parties, with the aim of making it easier for customers to compare products. The sharing of customer specific data will start in early 2020. This will enable consumers to access data about themselves (personal, account and transaction data) and share it with accredited third parties of their choice.

At the heart of open banking is trust in how open banking participants manage their customers’ data. We will continue to invest in our customers’ security and privacy, and apply our ethical principles to all data use and the outcomes that result.

Our Data Ethics Principles put our customers’ interests first in how their data is collected, used and disclosed; and provide mechanisms for transparency and choice to help our customers understand and control their personal information.

We will uphold these principles as the open banking regime begins, ensuring our customers can request the sharing of their data, while also maintaining control over where and how their data is used.

We are implementing digital solutions to assist our customers to improve their financial wellbeing. We have developed new features in the ANZ app to help our customers work towards their financial objectives by setting and tracking goals. Currently in the pilot phase, new features include data-driven ‘nudges’ (messages) to customers via the app, with milestones and tips to help them meet their savings goals.

Of the 2.8 million customers using our ANZ app, 36 percent are using mobile banking only – up 30 percent this year.

With increasing digitalisation, a strong cyber security capability is critical

As our customers choose to move their banking to digital platforms we are focused on safeguarding their money and personal information. We have invested heavily in our cyber security capability, and are in a strong position to keep our systems, data and customers safe from the increasing pace, scale and sophistication of cyber-attacks.

Recognising humans play a significant role in the security ‘ecosystem’, we are delivering comprehensive education programs for employees and customers, simplifying cyber security, and making it easier to understand and implement. This year we have developed workshops to help small businesses stay safe online, raised awareness of online scams and reached millions of customers through our campaign to help them protect their ‘virtual’ valuables. We are also helping to develop the cyber security curriculum for Australian high schools to ‘grow’ the next generation of cyber security workers.

Promoting a culture where security is everyone’s business means we are better placed to protect our systems, data and our customers, and can actively contribute to digital innovation and the economic opportunities a secure online world offers.

Biometric authentication protecting customer payments in Australia and New Zealand

ANZ was the first Australian bank to enable its customers to make high value payments (up to $25,000) via the ANZ app using their voice. Our voice ID technology allows customers to verify their identity using their voice, rather than a PIN or password. While still an emerging technology, we currently have almost one million customers in Australia registered for voice ID. To date there have been no instances of fraud from a voice biometric breach.

Supplementary disclosures

Refer to our 2019 ESG Supplement available at anz.com/cs in December for further disclosures, including historical data tables

1. Roy Morgan Research Single Source, Australian population aged 14+, Main Financial Institution, six month rolling average to Sep’19. Ranking based on the four major Australian banks.

2. DBM Business Financial Services Monitor. Base: Commercial Banking (

3. Retail Market Monitor, Camorra Research, six month rolling average to Sep’19.

4. Business Finance Monitor, TNS Kantar Research. Base: Commercial ($3 million – $150 million annual turnover) and Agricultural (>500K annual turnover) customers. Four quarter rolling average to Q3’19.

In certain instances ANZ makes:

- a community service payment in lieu of a payment to a customer account. In 2019 charity payments were made for ~111,000 accounts totalling ~$355,000.

- the customer payment via cheque. In 2019 cheques were issued for ~178,000 accounts Net promoter score totalling ~$11,088,000. A proportion of these cheques remain unpresented.