External operating environment

In Australia credit growth is slowing, revenue growth is negligible, interest rates are at record lows and regulation has increased substantially.

Competition too is intense, particularly in the home loan market. New competitors built to make the most of digital innovations to serve customers are also having an impact.

The housing market activity is improving off the back of the lower interest rates, and the removal of investor and interest only lending caps, but it is too soon to call a recovery.

Businesses remain cautious and are taking a ‘wait and see’ approach with the economy. Investment continues to be below long- term averages.

Business strategy outcomes

Momentum has returned in home lending with applications up 34% in the second half of 2019 (compared with the first half ), through improving turnaround times and greater clarity on lending policies, adjustments to lending caps and a major marketing campaign to restore confidence across our distribution channels. Weare confident this will flow through to settlements.

More than half of our customers now bank digitally and the ANZ App has 2.8 million users making more than $380 million worth of transactions every day.

Our ANZ Business Growth Program has created more than 1,300 jobs and participants have increased their revenue by 374% and profit by 461%.

Through our network and insights, our customers continue to succeed in Asia and more than 200 have joined us for delegations to China, Hong Kong, Singapore, Vietnam and Japan.

Performance

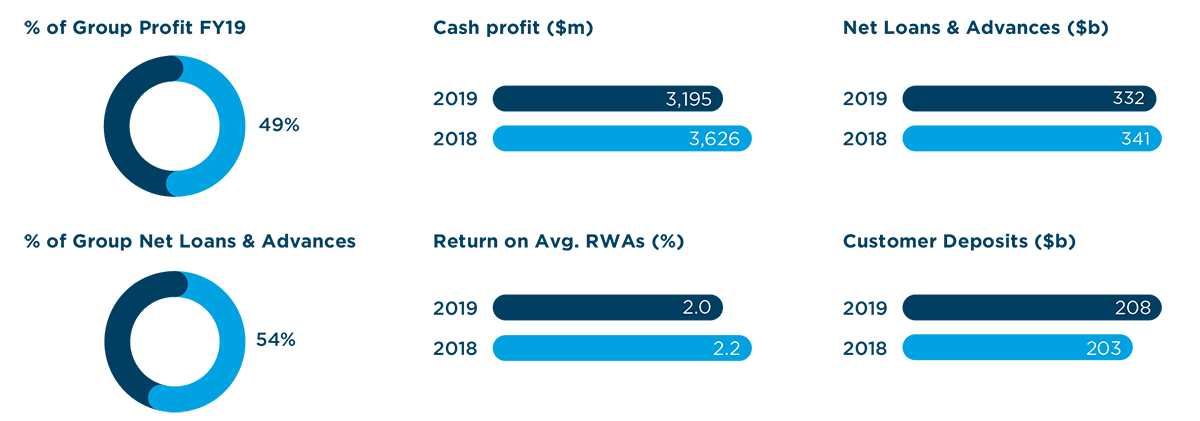

2019 was a challenging year for Australia Retail and Commercial, impacted by continued margin erosion, lower average lending volumes (a combination of the external environment and ANZ conservative business settings) and reduction in fee Income.

The home loan portfolio, down 3%, was affected by slowing system credit growth, competition and more conservative home loan origination risk settings. Commercial Lending, also down 2%, was driven by lower volumes in Small Business Banking.

Customers grew by more than 130,000 in the year to 6.4 million, with 3.6 million customers now digitally active. Deposits also increased in 2019 to $208 billion, with Retail deposits up 1% and Commercial up 5%.

Productivity initiatives, including workforce and branch optimisation delivered cost savings and offset increased investment spending.

Financial Performance for Australia Retail and Commercial is provided within the Our Performance section on pages 52 to 65.