External operating environment

Market conditions have been challenging, particularly in the second half of this financial year. This is due to a combination of record low interest rates, high liquidity, low volatility, and heightened geopolitical tensions.

China has been adapting to a slowing economy, while the inverted US Treasury yield curve sparked fears of a potential economic recession in the world’s largest economy.

Shifts in trade and supply chains due to

the US-China trade war have had a positive impact on some markets, particularly in South-East Asia, where ANZ has a presence.

ANZ is also well prepared for Brexit with our European branch network and licensing arrangements meaning customers do

not need to make changes or open new accounts in order to continue to bank with us in Europe.

Business strategy outcomes

Institutional is focused on customers who value us, working within clear priority sectors, sharpening our geographic focus, simplifying products and technology and driving structural efficiencies.

Following our decision to exit lower returning and non-core customer relationships, Institutional is now in the process of pivoting to responsible and disciplined growth. We have also maintained our focus on reducing costs and capital efficiency.

This has delivered leading market positions across key geographies (#1 Australia & NZ, #5 Asia) and #1 in overall relationship quality for the second year running.

The sale of Retail, Commercial and SME in Papua New Guinea completed in September 2019 has enabled the business to focus on Institutional banking. The sale of our stake

in Royal Bank in Cambodia (completed in July 2019) was also an important step in our simplification strategy.

Performance

Institutional continued to deliver the benefits of a simpler and more disciplined business

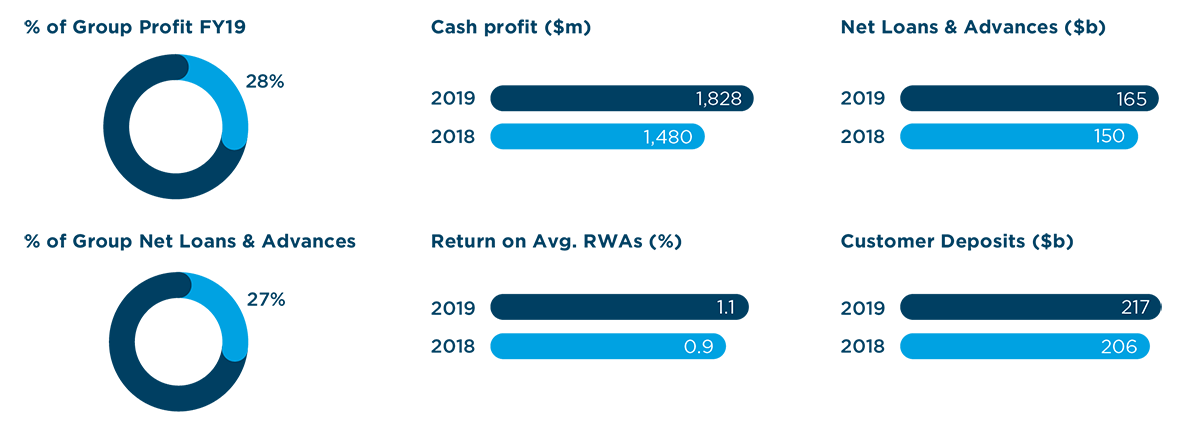

in 2019, reporting an increase in Cash Profit and growth in the balance sheet. Net Loans and Advances were up 10% while customer deposits grew 6%.

Geographically, Australia, New Zealand and Asia Pacific, Europe & America all delivered profit growth, supported by strong customer revenue growth.

Transaction Banking and Loans and Specialised Finance both increased revenue in 2019, up 8% and 7% respectively. Markets revenue was down marginally due to lower Balance Sheet revenue, while Franchise Sales and Franchise Trading both delivered stronger revenue outcomes.

Focus on productivity contributed to another year of cost reductions, a result of lower full time equivalent staff, decrease in software amortisation and property efficiencies.

Credit charges remained below long run trends.

Financial Performance for Institutional is provided within the Our Performance section on pages 52 to 65.