-

Ageing populations across Australia, Asia, Europe and the US are increasingly shaping strategy in the food, beverage and agribusiness sector, from product design to store layout and beyond.

This shift is creating opportunities right across the supply chain. Manufacturers, retailers, hospitality operators, e-commerce providers and investors can each pull specific levers to solve everyday problems, and each lever can create value.

Older consumers want food that tastes good while delivering protein, comfort and ease in formats that fit smaller households.

Companies that design for real life - clear labels, easy-open packs, calmer stores, and dependable daytime delivery - will earn loyalty and a chance to take advantage of the opportunities on offer.

Clear shift

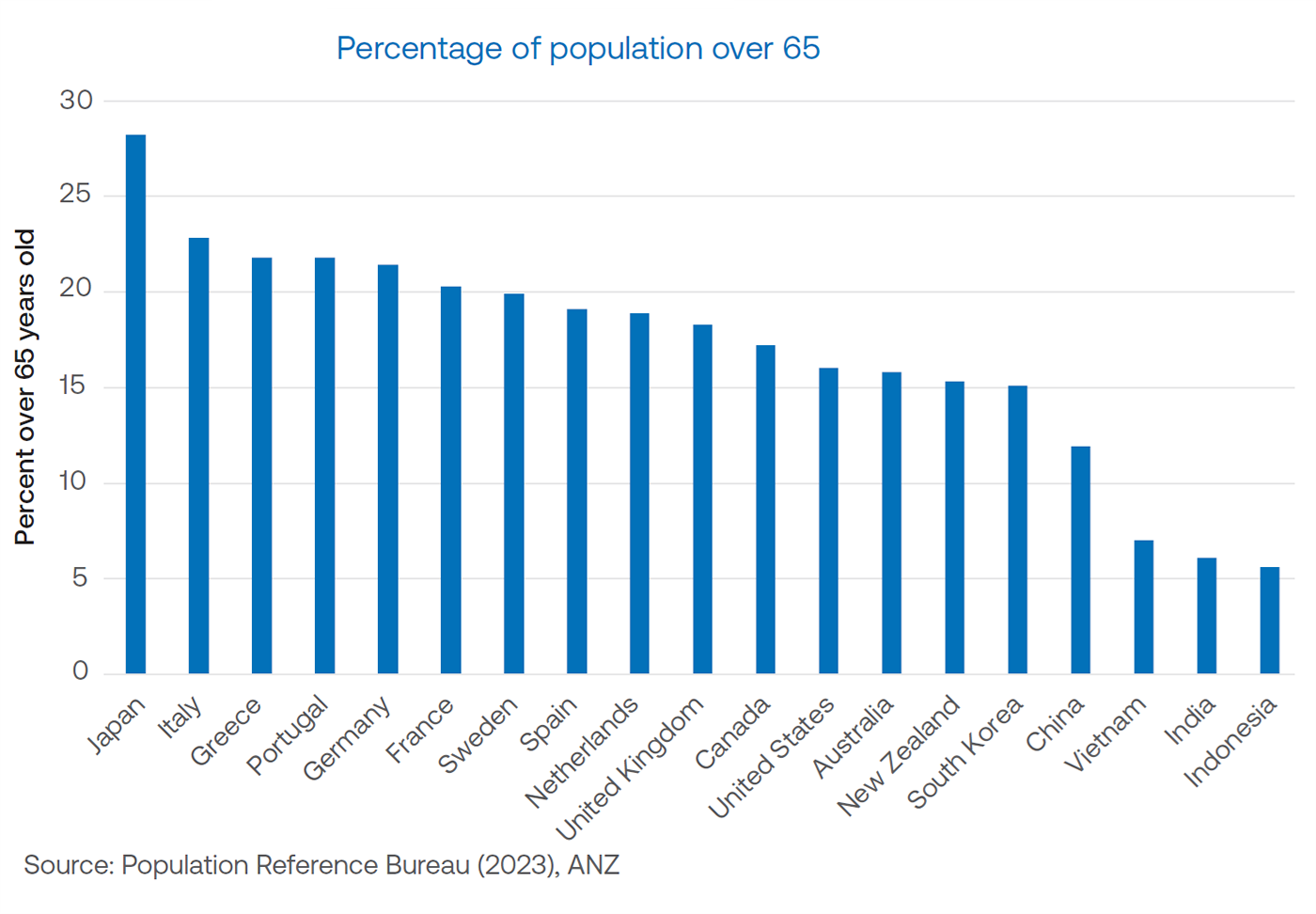

Populations are ageing across most developed markets. In Australia, around 23 per cent of people are 60 plus, and a little over one in six are 65 plus, while about 18 per cent are under 15 - a clear shift in the centre of gravity.

Japan now has close to three in ten people aged 65 and over. South Korea sits close to the United Nations threshold for a ‘super-aged’ society, with its 65 plus share climbing toward one in five and rising quickly. China has already passed the one-in-five mark for its 60-plus cohort.

All around the world families are smaller, people marry later, and life expectancy is higher, so more people are living longer, healthier lives.

At the risk of oversimplification, older consumers can be divided into two cohorts. The first is ‘active longer’, people in their late fifties through their seventies who want food that fits busy days and supports strength. The second is ‘later life’, individuals in their late seventies and eighties who value comfort, safety and ease above variety.

The line between them moves by household and by health, which is why companies may consider building product ranges that adjust with people, instead of tagging products as ‘for seniors’.

Many individuals in their sixties and seventies are still working, travelling and playing sport. Meals for older consumers should provide steady energy to avoid afternoon dips, enough protein to preserve muscle and strength, textures that do not tire the jaw and packaging that opens without strain to help people retain their independence.

Protein guidance for healthy older adults commonly lands at about one gram per kilogram of body weight per day, with higher targets for those who are very active or in recovery. That need is rising while total appetite often falls, which pushes food makers toward higher protein per serve and more obvious numbers on pack.

Consistent pattern

As consumers move into their sixties and seventies, consistent patterns emerge. Shoppers reach for protein-labelled dairy products because they are an easy way to meet daily targets.

Mince, pulled meats and slow-cook cuts replace weekday steaks since they are versatile and comfortable to eat. Boneless, mild fish sells when packs are portioned for a single pan with simple reheating notes.

Fortified everyday foods become common - calcium and vitamin D in dairy, fibre in bakery, lower-GI cereals for steadier energy. Drinks get lighter with tea-based options, broths and electrolyte waters.

Packs shrink to one or two serves so food stays fresh and waste falls, and resealable lids become standard so smaller households can pace themselves.

None of this feels medical. It is ordinary food, tuned to how people live now.

The scope of this shift extends to supermarkets, which are changing the standard shopping experience itself. Quieter trading windows with lower lights and less noise help many shoppers and match older daytime routines.

Sections that carry supplements and medical nutrition products are shifting closer to fresh meals so an older shopper or carer can do both jobs in one pass. Expect more end-of-aisle displays that pull together a complete dinner for one or two - protein, sides, dessert - instead of sending people hunting across the store.

Independent stores - local butchers, bakeries and greengrocers - can stand out by cutting and packing for purpose: boneless fish, thigh fillets sized for two plates, half-loaves of sliced sourdough, vegetable packs shaped for soups and stews.

The advantage is service, not a tiny price difference. Useful advice on cuts, reheating and freezing earns repeat business faster than shaving a few cents.

Hospitality and quick service restaurants are reshaping offers to match a daytime rhythm, with lunch now the main social meal for many older diners. Menus lean toward smaller bundles and mains that deliver meaningful protein without heavy salt, with sides that balance comfort with fibre.

Clear but unobtrusive cues make choosing easy - grams of protein on the board, a discreet mark for dishes that are easy to chew and a set of lighter beverage pairings that feel right for the middle of the day.

E-commerce keeps growing as older consumers become more digital, yet they still prefer clear, uncluttered screens. The experience should feel effortless: sign-in that takes seconds, baskets that stay saved between sessions and type that is easy to read without zooming.

Delivery windows work best in the mid-morning or early afternoon when people are at home, and a live phone line for changes prevents abandoned orders when plans shift.

Substitutions should be predictable and respectful - swap out-of-stock products with the same product from a different brand, rather than substituting yoghurt for custard - so trust builds with every delivery.

A growing share of orders will go to places rather than households. Retirement villages, clinics and community kitchens need bulk deliveries that are easy to handle: easy-open case packs, meals with the right texture and hydration aids.

They also need reliable chilled delivery so food stays at safe temperatures from the supplier to the kitchen.

When something is out of stock, swap in a like-for-like item so kitchens can keep to the menu. The same design rules apply to home care where more people will age in place and receive scheduled deliveries.

Opportunities

An ageing customer base opens different opportunities across the food and beverage value chain.

In a way, food and beverage manufacturers can treat the needs of older consumers as a set of practical requirements. A number of examples highlight the kind of actions manufacturers could implement to better serve this market.

Product descriptions could specify protein per serve – such as 20 grams to 25 grams in mains and 10 grams to 15 grams in snacks - delivered in food that still tastes like dinner. Salt levels can be kept modest where possible, with softer-texture versions of popular dishes so the same recipe is still palatable to older consumers.

Packs need to be easy to hold and open, with resealable lids as standard so smaller households can pace consumption. Labels could use large print and strong contrast so they are readable at arm’s length.

Local execution matters: in Japan and parts of Korea, some food is sold with icons indicating chewability or texture, so adding these will let shoppers immediately know how easy the food will be to eat; in Europe, proof on recyclability and material weight is expected; in the US, clear protein numbers paired with heart-healthy framing help decisions at shelf.

A concrete example is a two-serve cottage pie that delivers 22 grams of protein per serve, uses a peelable film and includes a short reheating guide on pack.

For supermarkets and convenience chains, there is an opportunity to arrange shop floors around what people are trying to do, not just how products are stored in the back room.

Loyalty data can flag suburbs with older customer bases so the range in the local supermarket tilts toward soft-chew proteins and one or two serve packs where they matter most.

Clear shelf tickets and simple icons for texture or protein content help decisions at a glance. A practical pattern is a ‘dinner tonight’ bay that pairs salmon portions with pre-cut vegetables and a light broth in grab-and-go sizes.

Ageing is not a side story. It represents a steady shift in who buys, when they shop and what feels right at the table.

The companies who pay attention to this - whether clearer packs, rightsized portions, protein that is easy to enjoy and services that work in daylight hours - will earn trust, one basket at a time.

Michael Whitehead is Executive Director of Food, Beverage and Agribusiness Insights at ANZ

This article is an edited excerpt of ANZ’s Summer 2025/26 “Food for thought” report.

Receive insights direct to your inbox |

Related articles

-

The year 2026 is not without risks - but considerably fewer risks than 2025.

2026-01-20 00:00 -

Investment in the FB&A space will move into a new stage in 2026.

2026-01-05 00:00 -

For business, the geopolitical environment was a constant presence in 2025. Not much is likely to change.

2026-01-08 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.