-

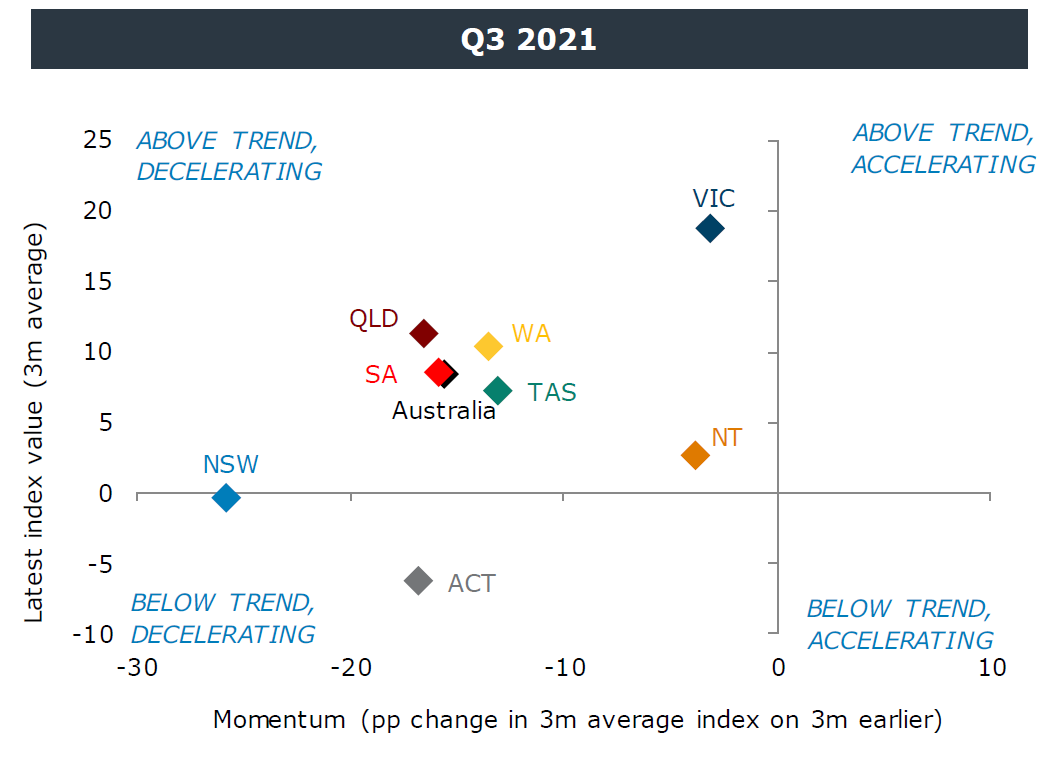

Economic momentum across Australia’s states and territories slowed in the three months to September, the ANZ Stateometer Index found, although activity remained largely above trend, and signs point to strength in the final quarter of calendar 2021.

Easing restrictions across the country point to a rapid economic rebound, based on ANZ-observed spending data, labour-market movements and the progressive border reopening. This gives ANZ Research confidence states and territories will see strong economic outcomes in coming quarters.

Across all states, closed international borders and stronger household savings rates will act as a perfect storm for strong spending, particularly on the east coast, where retail activity has been suppressed by lengthy lockdowns.

{video}

The ANZ Stateometer Index saw momentum decelerate in all states and territories in the three months to September, with New South Wales and the Australian Capital Territory dropping below trend.

Victoria appeared to perform well despite its lockdown but this was based largely on its soft performance in the previous corresponding period, while Queensland, South Australia and Western Australia were only bruised by their much shorter lockdowns.

Tasmania and the Northern Territory also continued to perform above trend, despite softening in the consumer component.

The ANZ Stateometer is a set of composite indices that measure economic performance across Australia’s states and territories.

For each jurisdiction, the index extracts the common trend across multiple indicators (between 24 and 32, depending on data available in the jurisdiction). The economic indicators are monthly data series and cover the consumer, business, housing, labour and trade sectors.

Developments across this diverse country are rarely uniform and we hope these geographically specific indices help you to see through the haze of state by state data and more intuitively piece together the state of the national economy.

Bansi Madhavani, Catherine Birch & Adelaide Timbrell are Senior Economists, and Arindam Chakraborty is a Junior Economist at ANZ

This story is an edited excerpt from the ANZ Research Stateometer Report, published November 25, 2021. Click HERE to read the full document.

Related articles

-

Households are feeling a bit better. Will this be sustained ahead of key inflation data and the August RBA meeting?

2024-07-26 00:00 -

Headline inflation could reach zero in Q3, but that’s unlikely to be cause for a rate cut.

2024-07-01 00:00 -

Globally, inflation is finally coming down - but progress has been slow and uneven.

2024-07-03 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.