-

FOREWORD

WE BEGAN BY ASKING “WHAT WILL AUSTRALIA, AND AUSTRALIANS, LOOK LIKE IN 2030?” BEYOND CONFIRMING THE THINGS THAT MANY OF US ALREADY SUSPECT, SUCH AS AN OLDER AND HEAVIER POPULATION, WE WERE STRUCK BY THE PROJECTIONS FOR A MORE DEMOGRAPHICALLY BALANCED WORKFORCE AND HIGHER LEVELS OF EDUCATION.

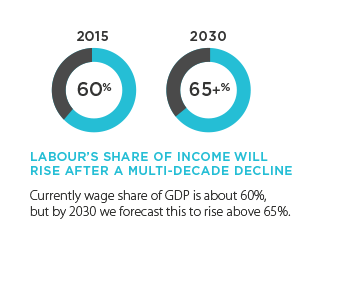

This led us to look more closely at the service sector, which we now believe will be an even more dominant force in the Australian economy than it is today. Crucially, we found that the services-driven economy of 2030 will be one where workers are in strong demand for the first time in several generations. While the dominance of Australia’s service sector is well covered in recent papers, a number of aspects of that story have been neglected to date.

In particular, the industries with the strongest growth prospects, such as health and education, are very labour intensive, but relatively capital ‘light’. When viewed in light of Australia’s ageing population, this means there could be significant shortages of skilled labour by 2030. It also means financial service providers and investors may have to adapt to a world with lower funding requirements.

KEY TAKEAWAYS

This paper forecasts a number of changes in Australia’s service sector over the next 15 years, and draws out the implications of those changes for Australia’s economy and business environment.

- The service sector will make up an even greater proportion of the Australian economy by 2030 (up 5% to 77.3%).

- In particular, the healthcare industry will expand as a result of an ageing population, while the education and professional services industries are set to benefit from growth in Asia.

- New business models and digitisation should see more Australian companies exporting their services to the region. Australia’s disadvantages of scale are less of a constraint in services.

- The shift away from goods, towards services, means businesses of the future will be less capital intensive and more people-dependent.

SERVICING AUSTRALIA’S FUTURE

Australia 2030

For a full set of relevant disclosures, please visit the link below.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.