-

After a very eventful and uncertainty-induced 2025, the outlook for 2026 is not without risks. But ANZ Research sees considerably less downside risk than in 2025.

Three themes are likely to dominate: the sustainability of the semiconductor supercycle; fiscal developments (particularly in Thailand, India, Indonesia and the Philippines) and overly accommodative financial conditions, which are very stimulatory for growth, and may necessitate earlier-than-expected policy normalisation.

The global trading system has adapted to the landscape of tariffs with much less disruption than first feared. The United States’ Supreme Court is expected to issue its ruling on the legality of US tariffs soon, although ANZ Research does not see a major backtracking regardless of the ruling. Geopolitical events — and there were quite a few in 2025 — are in focus again as 2026 begins but markets have been largely unmoved.

Asia’s economic performance ended 2025 on a strong note, with solid export growth and accelerating gross domestic product (GDP) growth. Such strength is unlikely to be sustained in 2026, but ANZ Research is not expecting a marked deterioration in activity — more a normalisation in growth from above-trend pace in some instances, akin to going from a gallop to a canter.

Boom

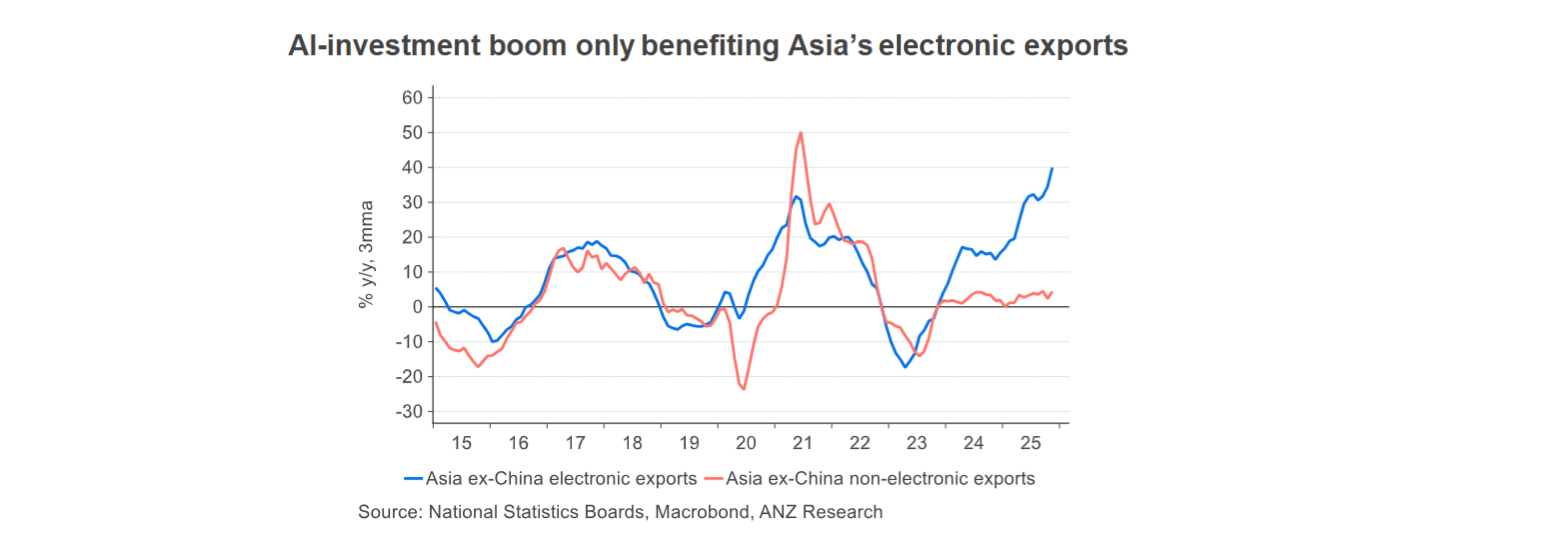

The AI-related investment boom was a major theme for 2025, heralding the start of a semiconductor supercycle, which boosted electronic exports in Asia and leading to stronger economic activity despite the US tariff-related uncertainty.

Export strength in the region has been uneven, reflected in the large divergence between electronic and non-electronic exports. This shows how narrow the export performance has been and how reliant it is on the AI-related investment boom. In its absence, growth in the region would have been materially weaker. In this way, the sustainability of the semiconductor supercycle is crucial for the region’s growth prospects.

While there have been concerns around equity market valuation for the hyperscalers and the broader market, ANZ Research’s focus is centred around whether the AI-related capex spending can continue in 2026 and beyond.

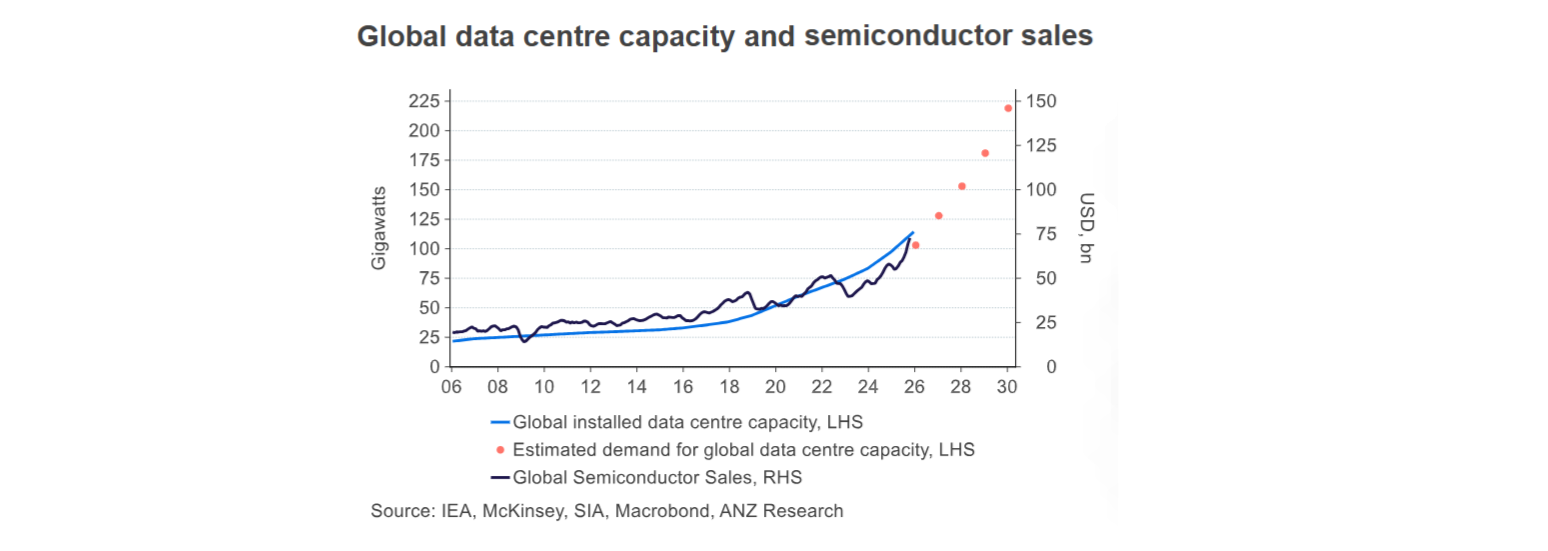

World Semiconductor Trade Statistics (WSTS) forecasts global semiconductor sales to approach $US1 trillion in 2026, a 26.3 per cent increase from 2025. Gartner expects worldwide AI spending to increase by 36.8 per cent in 2026 to $US2 trillion.

The buildup of data centres globally has been a key part of the AI-related investment boom, with the International Energy Agency (IEA) estimating global installed data centre capacity rose to 114.3 gigawatts (GW) in 2025. If the data centre buildout results in excess capacity, that would be a major concern.

However, McKinsey estimates demand for global data centre capacity will increase to 219GW by 2030, which if realised will require further investment that will keep the semiconductor supercycle going.

A risk to this view is if there is a sharp equity market correction as investors grow weary of valuations and there is a reassessment of the ability to generate adequate returns from the amount of AI investment. Should this occur, there will be a sharp cutback in AI-related investment leading to a falloff in semiconductor demand. This will significantly affect Asia’s electronic exports and growth prospects.

ANZ Research sees this as a tail risk at present but will monitor equity market sentiment closely for any hint the semiconductor supercycle may be at an end.

No universal theme

There is no universal fiscal theme for the region as a whole. Each economy is facing unique challenges, possibly with the exception of Singapore where the government is back to running primary surpluses and has ample fiscal space to be generous at its upcoming budget. Idiosyncratic factors and how they affect each economy’s fiscal situation will have an important bearing on the growth outlook.

In India, tax growth has unexpectedly declined amid a slowdown in nominal GDP and weakness in the financial cycle, which is straining both central and state government budgets. The central government can well manage given other rich sources of non-tax revenue and spending reduction when economic growth is strong. But state governments on the whole are increasing their borrowings from the market.

There are also early signs of private capex pick-up as industry credit growth has improved in the past few months. If this is sustained, there could be stronger competition for funds in 2026, implying Indian government bond yields could continue to rise even though growth is expected to slow. To ANZ Research, this points to emerging fiscal stress after several years of relative comfort, which may necessitate further central-bank support.

Indonesia’s policy stance has turned decisively pro-growth. The combination of a pro-growth bias and the absence of new, material revenue-raising measures means the possibility of a higher budget deficit ceiling remains an overhanging risk. The approved 2026 budget embeds optimistic revenue assumptions (including double-digit tax growth) at a time when growth outcomes could be softer than budgeted and the 2025 revenue collection undershot even the government’s downwardly revised outlook.

There is some room to reprioritise within the 2026 framework to manage revenue shortfalls or add targeted stimulus without breaching the 3 per cent of GDP deficit cap. But the flipside is a smaller boost to growth. ANZ Research assumes the government will keep the budget deficit just under the 3 per cent of GDP cap, compared to the target of 2.68 per cent of GDP. There is a possibility that off-budget spending could be utilised to support growth, or Bank Indonesia may have to do more via monetary policy and burden sharing.

Finally, in the Philippines, issues around flood-infrastructure have been a major drag on economic activity. Disbursements of capital outlay by the government between July and October 2025 fell 26 per cent compared to the same period in 2024. The contractionary fiscal stance has not only disrupted capital formation but also weighed heavily on sentiment, with businesses reluctant to commit new funds and households deferring discretionary spending. Transparency is being strengthened for all infrastructure projects, but it may take time for disbursements to normalise and for investor and public confidence to be restored.

Cutting

ANZ Research expects the US Federal Reserve to continue cutting interest rates in 2026 by a total of 50 basis points. ANZ Research sees the European Central Bank and Bank of England easing further as well but the easing cycle should be complete by the second quarter. In contrast, the Bank of Japan is forecast to hike in 2026.

This divergence in monetary policy in G3 economies will also be apparent in Asia. ANZ Research expects the People’s Bank of China to cut by 10 basis points in the second quarter, with the Philippines and Thailand cutting by 25 points in the first quarter, and Indonesia by 50 points in the second quarter. Rates in many other key economies, including India and Korea, are expected to remain on hold.

The risks to ANZ's Research's Asia monetary policy outlook are tilted towards earlier policy normalisation. Prolonged periods where rates stay unchanged at low levels are rare. Economic growth in the region has surpassed expectations with central banks recently revising their growth forecasts higher.

If the AI-related investment boom continues, further upward revisions to the forecast can be expected. At present, the region’s inflation is well behaved, even in India, which provides room for policymakers to remain patient. Yet the cumulative monetary policy easing in the region since the third quarter of 2024 has resulted in very accommodative policy settings.

When we incorporate broader financial market variables, overall financial conditions are at very stimulatory level. The process of policy normalisation could come sooner than expected for some central banks. Should this occur, the policy divergence with the Fed will be positive for Asian currencies.

Khoon Goh is Head of Asia Research at ANZ

The is an edited version of the ANZ Research report “Asia Macro Weekly: key macro themes for 2026”, published January 6, 2025.

Receive insights direct to your inbox |

Related articles

-

The global macro environment has been more supportive than expected, and another solid year is in prospect.

2026-01-09 00:00 -

Monetary policy is not helping household credit demand. Addressing debt, income growth, and confidence may be the answer.

2025-12-02 00:00 -

Patchiness in China’s economy has been held up by a strong export market – one that looks very sustainable.

2025-12-02 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.