-

The unexpectedly high rate of growth in Australia’s third-quarter trimmed mean inflation, released in October, is likely to have been a one-off occurrence. Overall, the balance of top-down indicators and influences suggests inflation in Australia is likely to moderate through calendar 2026.

Data from the Australian Bureau of Statistics showed Australia’s trimmed mean inflation printed at 1.0 per cent quarter on quarter in the three months to end September (3.0 per cent year on year), which was above market consensus. Trimmed mean for the second quarter was also revised upward.

Headline inflation printed at 1.3 per cent quarter on quarter (3.2 per cent year on year) while the monthly consumer-price indicator for September printed at 3.5 per cent.

But several factors suggest that result may be an aberration. These include business survey price and cost measures, the tendency for third-quarter inflation prints in recent years to come in on the high side, the easing in labour market conditions, gains in the Australian dollar trade-weighted index (TWI) and recent trends in oil prices.

In addition, Australia’s unemployment rate is drifting higher, and there are signs of softness in leading indicators including the ANZ-Indeed Australian Job Ads series.

All things considered, ANZ Research views a final, 25-basis-point cut to the official cash rate in the first half of calendar 2026 as the most likely path for monetary policy.

Come together

A number of one-off factors came together in the September quarter to push the trimmed mean higher. Indeed, if property rates and charges, tobacco and electricity prices had all risen 2.5 per cent quarter on quarter in original terms and petrol prices hadn’t changed, then trimmed mean would have printed about 0.14 percentage points lower.

Those items are important because they are either heavily influenced by government decisions or particularly volatile. ANZ Research’s broader view is the trimmed mean inflation measure, like all data, can contain some noise alongside the underlying signal.

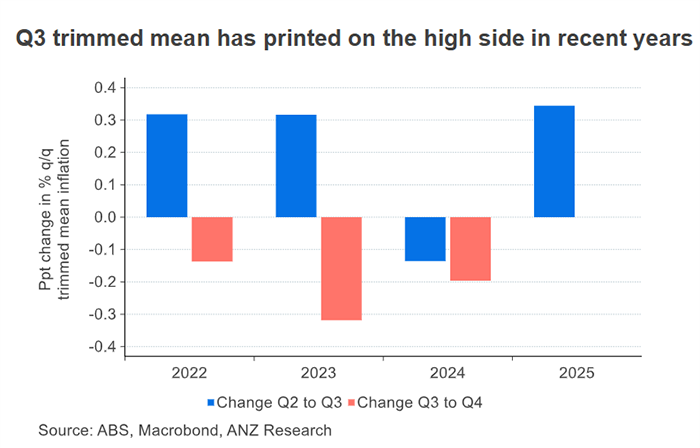

In recent years, September quarter trimmed mean inflation has shown a tendency to come in above the June and December quarter results. Indeed, the lift in inflation in 2025 looks a little less remarkable when considered in this light.

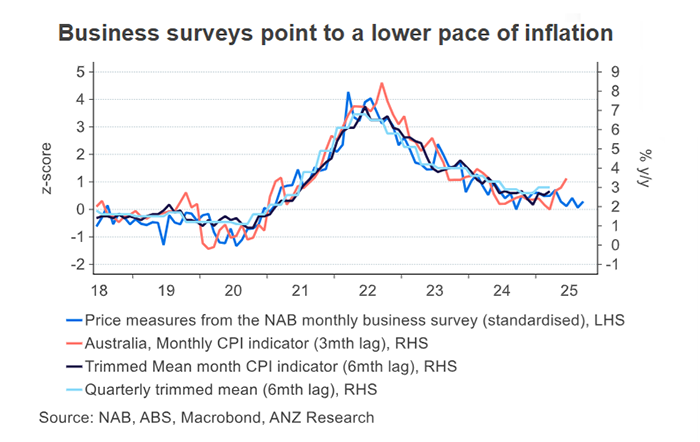

Business survey measures of prices and costs also show the broader trend toward inflation around the ‘mid-2s’ remains on track. While the correlation between quarterly trimmed mean inflation and these survey measures was weaker prior to 2018, the absence of a broader lift in cost and price pressures in recent surveys is encouraging.

These survey-based measures also point to inflation pressures being higher than in the pre-pandemic years.

Market services inflation (excluding volatile items) remains relatively high, with disinflation stalling in the September quarter. Data shows it is typical for services inflation to run well ahead of goods inflation and that the current pace of services inflation is not necessarily excessively high.

ANZ Research finds yearly changes in its own full-employment measure, FTE-Pop, tend to have a reasonable relationship with an acceleration or deceleration in market services inflation. A recent decline in this measure means the year-on-year change will remain negative for the next few quarters — in the absence of any surprise tightening in the labour market. That, in turn, points to a little downward pressure on services inflation.

FTE-Pop also remains in the 57 per cent to 58 per cent range that typically sees inflation in the RBA’s 2 per cent to 3 per cent target band.

Across the docks

Recent gains in the $A TWI point to a decline in ‘across-the-docks’ inflation. The relationship between imported goods prices and overall inflation is not particularly tight, with scope for importers, wholesalers and retailers to expand or contract margins.

Imported goods are unlikely to be a strong source of inflation in coming quarters and may be a source of disinflationary pressures. Oil prices are also unlikely to be a source of persistent price pressures. Indeed, if anything, the decline in the Australian-dollar oil price over the past year points to lower inflation.

One indicator that does point to higher inflation is nominal unit labour costs - in essence, a combination of wages and productivity. While wages growth is consistent with at target inflation, ongoing weak productivity suggests the combination is consistent with higher inflation. However, much of the weakness in productivity growth over recent years reflects the fall in mining-sector productivity and the expansion of the non-market sector.

It’s debatable whether the decline in mining sector productivity would have much impact on price pressures across the broader economy, especially at a time when the mining sector’s call on resources (labour and capital) has been stable for some time.

Re-estimating nominal unit labour costs excluding the mining sector from the productivity component shows only a little upside pressure on inflation. The relationship between nominal unit labour costs and inflation has not been particularly tight in the short run over the past decade or so.

Overall, these data suggest inflation is likely to moderate. That said, inflation above the 2½ per cent mid-point would appear more likely than inflation below 2½ per cent, with a return to the pre-pandemic era of very low inflation looking unlikely.

Adam Boyton is Head of Australian Economics at ANZ

This story is an edited version of the ANZ research report “Australia’s trimmed mean solidifies RBA hold”, published October 29, 2025.

Receive insights direct to your inbox |

Related articles

-

Tit-for-tat activity is a part of life when it comes to China-US trade tensions.

2025-10-22 00:00 -

Gold’s rise goes beyond a demand story and could point to underlying issues.

2025-10-16 00:00 -

Australia’s bond market continues to outperform, with strong demand from Asian investors and growing participation from New Zealand corporates. Structural shifts and elevated yields are reshaping regional capital flows.

2025-10-10 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.