-

Growth in several key economies across Asia in the second quarter of 2025 was boosted by tariff-inspired export activity destined not to last. With the tariff situation much clearer and domestic demand in a dull state, a more moderate growth trajectory lies ahead.

Lower interest rates and broadly neutral fiscal policies are unlikely to have a significant impact on growth. Asian currencies will benefit from United States (US) rate cuts, and ANZ Research expects further appreciation even amid slowing regional growth.

Taking into consideration both the first-half gross-domestic product (GDP) growth outturns and oncoming potential headwinds, ANZ Research has revised its Asia 2025 growth forecast to 4.9 per cent, from 4.1 per cent in its previous assessment.

Frontloading

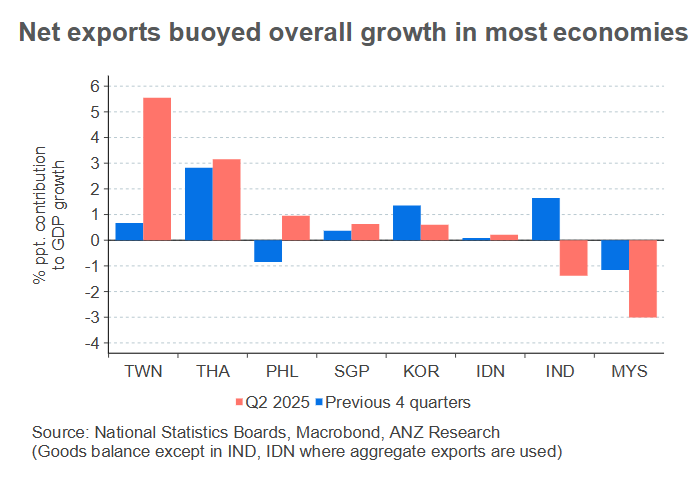

Stronger-than-anticipated second-quarter growth notwithstanding, the forward trajectory is likely to be more subdued. Exports were pivotal in boosting growth in that period, even on a ‘net’ basis in most economies. This included mainland China, where net exports are estimated to have contributed 1.2 percentage points to aggregate GDP growth of 5.2 per cent year on year.

The buoyancy in exports was due to the pause in the implementation of US tariffs that extended the frontloading phase of Asian exports, and ongoing strength of tech-related spending in the US. Nominal spending on information processing equipment and software in the US grew at an average pace of 12.5 per cent year on year in the first half of 2025, more than double 2024.

With tariff rates now finalised, frontloading activity should normalise in the coming quarters. The 15 per cent to 20 per cent range for most economies is still a substantial mark-up from the universal rate of 10 per cent in effect until early August.

Faced with a 50 per cent rate, India’s exports are particularly vulnerable. While ANZ Research acknowledges the possibility of this level eventually being halved, the impact on export competitiveness will not be trivial. It could also impact domestic employment, as the bulk of India’s tariffed exports is in labour-intensive sectors.

There is still some ambiguity over tariffs on semiconductors, but it is conceivable demand for the advanced varieties from South Korea and Taiwan will hold until US tech spending subsides. Non-tech exports are likely to remain under pressure.

Domestic demand

Weakness in domestic demand will continue to constrain growth. The private consumption impulse, or the flow of new consumption relative to GDP, has either moderated or remained static in most economies except the Philippines.

The weakness in this GDP-based metric is supported by the ongoing dullness in high-frequency indicators such as retail and auto sales. The post-pandemic nature of job creation has been concentrated in low-paying jobs in segments like food and accommodation, which has weakened consumption.

In the Philippines the strength of private consumption has been driven by credit card spending and loans against salaries. Growth in borrowing for asset creation, like mortgages, has been relatively muted, underscoring household concerns over income prospects.

A similar pattern has emerged in India, where household borrowings have not only slowed but are increasingly being collateralised by jewellery and financial assets. These developments are symptomatic of stress on household incomes and balance-sheets, in ANZ Research’s view. Based on the slowdown in household credit and weakness in other indicators such as auto sales and revenue growth of consumer product companies, ANZ Research is circumspect about the 7 per cent year-on-year rise in private consumption between April and June 2025.

Retail sales in mainland China have also come under strain. Still, ANZ Research thinks extended consumption subsidies will provide adequate support. Through policies to expand the social welfare system, mainland Chinese policymakers are attempting to lower precautionary savings and sustaining domestic demand. But a significant step-up in domestic demand is unlikely as the property sector is still far away from a meaningful recovery and youth unemployment remains high.

Second-quarter outcomes for capex were more mixed. On an annual basis, it strengthened in roughly half of the region, including Indonesia, Malaysia, Taiwan and Thailand.

ANZ Research does not expect this strengthening to be sustained except in Taiwan, which continues to benefit from the global tech cycle. Vietnam does not publish GDP-based investment data on a quarterly basis, but ANZ Research suspects sustained foreign-direct investment flows are keeping capex buoyant.

ANZ Research is less sanguine on the continuation of capex momentum in the others. A recent visit to Malaysia suggested capex in plant and equipment is likely to moderate on the back of higher tariffs. In Indonesia, public infrastructure — and not private capex — led to the 6.9 per cent year-on-year jump in overall capex in the second quarter of 2025. Given the evolving contours of fiscal policy, ANZ Research thinks that is unlikely to be sustained.

Finally, the rise in Thailand’s capex was largely due to a favourable base, with the absolute level being the lowest in four quarters. Weak business sentiment does not portend a real improvement ahead.

Incrementally neutral

Policymakers in some economies, notably in Indonesia and South Korea, have expanded budget deficit targets. Based on the first half of 2025, there is greater fiscal flexibility in both economies for the remainder of the year.

In contrast, Malaysia and the Philippines will need to contend with tighter fiscal policies if the 2025 budget deficit targets are to be met. Malaysia’s recently announced welfare measures, amounting to 0.14 per cent of GDP, are likely to be accommodated by a commensurate reduction in developmental spending.

The scope for monetary policy easing has been augmented by the stability of the $US and the commencement of rate cuts in the US. Even so, central-bank commentary suggests the bulk of rate cuts in the region are now behind us.

Only in Indonesia, Thailand and South Korea does ANZ Research see scope for more cuts. There is a single cut left in the Philippines and none in Malaysia. ANZ Research anticipates a 20 basis-point reduction in mainland China, likely in two steps.

The efficacy of monetary policy easing seems limited, and so far has been more likely to lessen debt-servicing burdens than augment credit. Other than the Philippines and Vietnam, credit growth has softened in the region.

In Thailand, credit has contracted in 2025. Higher levels of public debt are unlikely to allow strong counter-cyclical fiscal policies in 2026. The 2026 budget targets for Indonesia and Thailand imply a neutral to mildly negative fiscal impulse. Slowing nominal GDP growth could diminish revenue buoyancy and make it difficult to achieve projected budget targets.

Finally, the direction of travel for fiscal policy in mainland China is likely to differ from the rest of the region, with the consolidated fiscal deficit staying at around 10 per cent of GDP over the next few years.

All up

ANZ Research’s growth forecast revision to 4.9 per cent contains a significant upgrade for mainland China, Singapore, Taiwan and Vietnam. Its 2026 GDP growth forecast for the region is 4.7 per cent, when ANZ Research expects the full impact of tariffs and slower global growth to hit economies.

Inflation has been, and should remain, below the midpoint of the official forecast ranges. Benign commodity prices, including food and energy, and sluggish domestic demand will likely constrain both core and headline inflation. Subdued inflation has seen real policy rates remain high, despite reductions in the policy rates in all economies barring Taiwan and Vietnam. Based on ANZ Research’s policy rate and inflation forecasts, this situation is likely to persist.

ANZ Research expects current account positions to remain broadly stable in the coming quarters in most economies. These will be particularly important to monitor in Malaysia and the Philippines. Malaysia’s current surplus almost fully eroded in the second quarter and could remain low until the domestic investment cycle is fully satiated. The Philippines continues to record sizeable current account deficits of more than 2.5 per cent of GDP.

The path for financial accounts is less clear. But conditions for a revival in foreign portfolio flows are falling into place — elevated real interest rates and monetary policy easing into its final stage, at a time when it is just commencing in the US, should encourage fixed income flows into the region.

ANZ Research also thinks even a small diversification of portfolio investments away from US assets could yield substantial flows into the region. This diversification is not yet evident with portfolio flows continuing to be volatile.

Diversification will be a non-linear and gradual process. Portfolio inflows can, to an extent, offset subdued FDI inflows into the region. Portfolio flows into the region have remained volatile and selective until now. Nonetheless, a steadier path should emerge over time, probably once the US monetary easing cycle becomes more entrenched.

Paving the way

ANZ’s Research’s most recent quarterly assessment of these economies outlined arguments for rates to consolidate at lower levels, including the domestic rate-cutting cycle and broadly manageable supply outlook. The US rate-cutting cycle has since resumed, paving the way for easy global monetary condition, while the benign domestic macro drivers have persisted.

However, the rich valuation of Asia local currency bonds (LCY), in ANZ Research’s view, has reflected the favourable global and local dynamics and risks around yields would be more balanced going forward. Of note, Asia’s weight in a major emerging markets (EM) LCY bond index is set to be reduced in the first half of 2026, in favour of increasing the weights of higher yielding EM peers.

While Asia local markets remained supported in the third quarter amid EM rallies, the performance was not uniform across markets — with 10-year yields higher in China, India and Vietnam while trending lower elsewhere. Idiosyncratic risks have resurfaced, as the fiscal position is at risk of deteriorating in select economies. The key watchpoints for the coming quarter are highlighted in the ANZ Research’s full report.

These include ongoing change in Thailand and Indonesia. ANZ Research does not expect any meaningful change to the Thai policy outlook, but its focus on reviving economic growth should limit further downside to bond yields most immediately. Updates on Indonesia’s 2026 budget, fundraising plans, and central bank financing strategies will also be watched closely.

Meanwhile, worries over fiscal risks in India and ongoing reflation in China have sent bond yields higher, but ANZ Research expects better demand at current levels to help yields consolidate. The Indian government has maintained its second-half bond supply target for the financial year starting April 2025, despite fresh tax incentives. The US-India tariffs negotiations are underway and could reshape its fiscal outlook.

Sanjay Mathur is Chief Economist Southeast Asia & India, Khoon Goh is Head of Asia Research, and Jennifer Kusuma is Senior Asia Rates Strategist at ANZ

This is an edited version of the ANZ Research report “Asia Economic Outlook Q4 2025: life after frontloading”, published September 25, 2025

Receive insights direct to your inbox |

Related articles

-

Australia’s China opportunity is entering a new phase, ANZ’s Raymond Yeung explains.

2025-10-09 00:00 -

ANZ Research no longer expects a rate cut in Nov; Feb next plausible option

2025-10-06 00:00 -

The US dollar will remain dominant, but its influence in Asia is gradually waning. Regional currencies like the renminbi are gaining traction amid global policy uncertainty.

2025-10-02 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.