-

China’s recent restrictions on exports of rare earths triggered an immediate threat of an additional 100 per cent tariff from the United States.

The restrictions — aimed at securing favourable terms in its trade deal with the US — show Chinese officials remain confident of reaching 5 per cent growth in 2025, even with the threat of further tariffs.

Recent experience with the US administration suggests the White House may act quickly, prompting reciprocal action from China such as tariffs and export controls. This tit-for-tat is likely to continue for some time, with periodic negotiations. This repeated cycle is a new normal in the ongoing trend of China-US economic decoupling.

The two central issues for a US-China agreement are China's commitment to stable rare-earths supply and clear terms around the sale of social media platform TikTok, especially regarding data privacy. These considerations are more significant than the size of trade balance.

Trade talks in Geneva, London, Stockholm and Madrid appeared to progress well, and included an initial agreement on a TikTok deal. However there have been many small moves between the two sides over September and October.

Moves from the US have included adding 23 Chinese firms to its restricted entity list, increasing port fees for Chinese ships, imposing sanctions over China's Iranian oil purchases and suggesting bans for Chinese airlines flying US-China routes via Russian airspace. For its part, China has banned technology companies from buying Nvidia’s AI chips.

In ANZ Research’s view, the tit-for-tat between China and the US is daily routine.

Remained steady

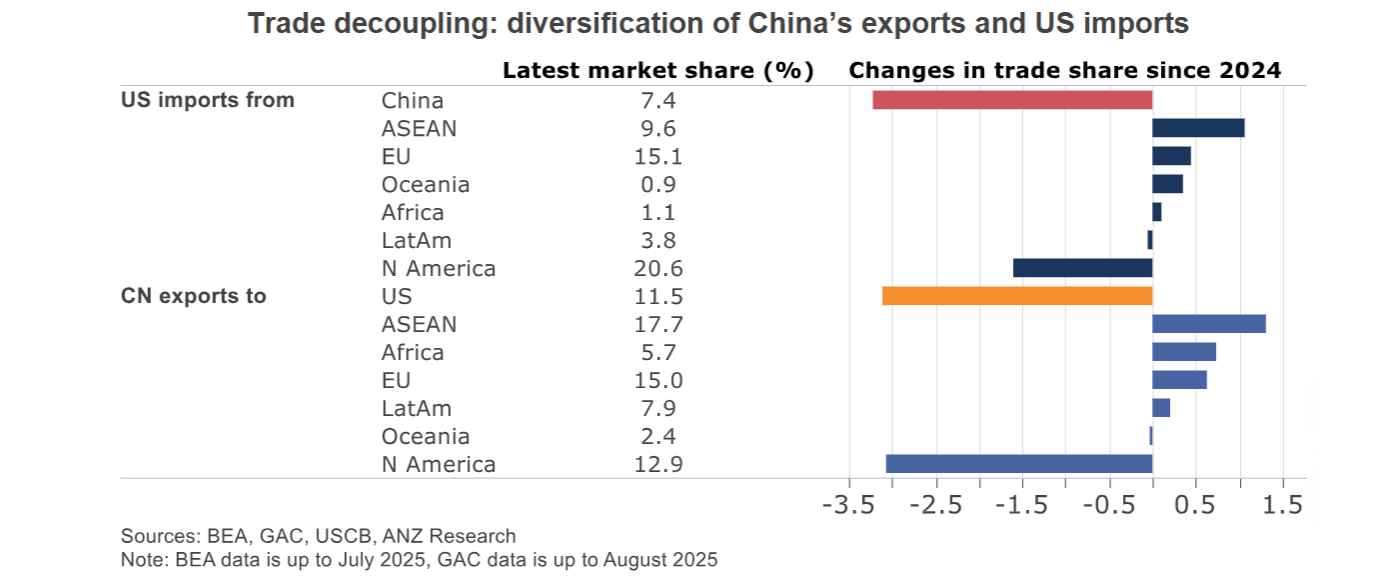

China’s exports have remained steady despite tariff pressures. Exporters have expanded into new markets and adjusted supply chains. By August 2025, direct shipments to the US accounted for 12 per cent of China’s total exports, down from 19 per cent in 2018.

Strong sales of newly released iPhone models and related products are expected to support China's electronic supply chains and export levels in the fourth quarter.

China likely knows the consequence of restricting rare earths exports. But they are still taking such a risk, just ahead of the release of its third-quarter growth data, suggesting authorities are comfortable with the economic performance in the near term. They are prepared to take risks for favourable terms in the trade deal.

In hindsight, the immediate market reaction to the tariff warning from the US seemed excessive. ANZ Research still believes China's economic slowdown is mainly due to domestic factors like property, not the trade tensions. There is no change to ANZ Research’s GDP forecast for 2025 or 2026.

That said, the trade shock could reignite hope for additional stimulus in the fourth quarter, likely via fiscal injection. The slowdown in economic activity since August is partly a self-induced outcome of anti-involution including investment curb. Though unlikely, the government could ease this policy stance to offset any impact from US tariffs.

ANZ Research expects China will maintain exchange rate stability. The People's Bank of China could reinforce its policy stance through a firmer daily fixing in response to potential depreciation pressures. In fact, China's real effective exchange rate has declined due to domestic deflationary factors. It does not need to adopt competitive devaluation.

Trade decoupling is likely to boost China's efforts to reduce reliance on the US dollar and promote the yuan as a global reserve currency. The US administration is expected to collect about $US12 billion monthly from the tariffs on Chinese goods at a 43 per cent effective rate, according to a recent paper by the New York Federal Reserve.

China used to recycle its trade surplus into US dollar assets like US Treasury securities but earned just $US2.5 billion (4 per cent yield on $US731 billion holdings, not counting its holding via Belgium). If the $US stays weak, this financial arrangement appears less beneficial for China.

Raymond Yeung is Chief Economist, Greater China at ANZ

This is an edited version of that ANZ Research report “China-US: tit-for-tat is a new normal”, published October 13, 2025.

Receive insights direct to your inbox |

Related articles

-

Data show falling consumer confidence and rising inflation expectations ahead of the RBA’s November meeting.

2025-10-17 00:00 -

Gold’s rise goes beyond a demand story and could point to underlying issues.

2025-10-16 00:00 -

Australia’s bond market continues to outperform, with strong demand from Asian investors and growing participation from New Zealand corporates. Structural shifts and elevated yields are reshaping regional capital flows.

2025-10-10 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.