-

China’s property market will transform from a construction-based one to a services-based one over the next decade, as a result of the economy’s new development model that aims to address challenges seen in the sector in recent times.

The result will be an industry ultimately less critical to China’s broader economy — and therefore, ANZ Research does not expect any large stimulus activity in the sector in the future.

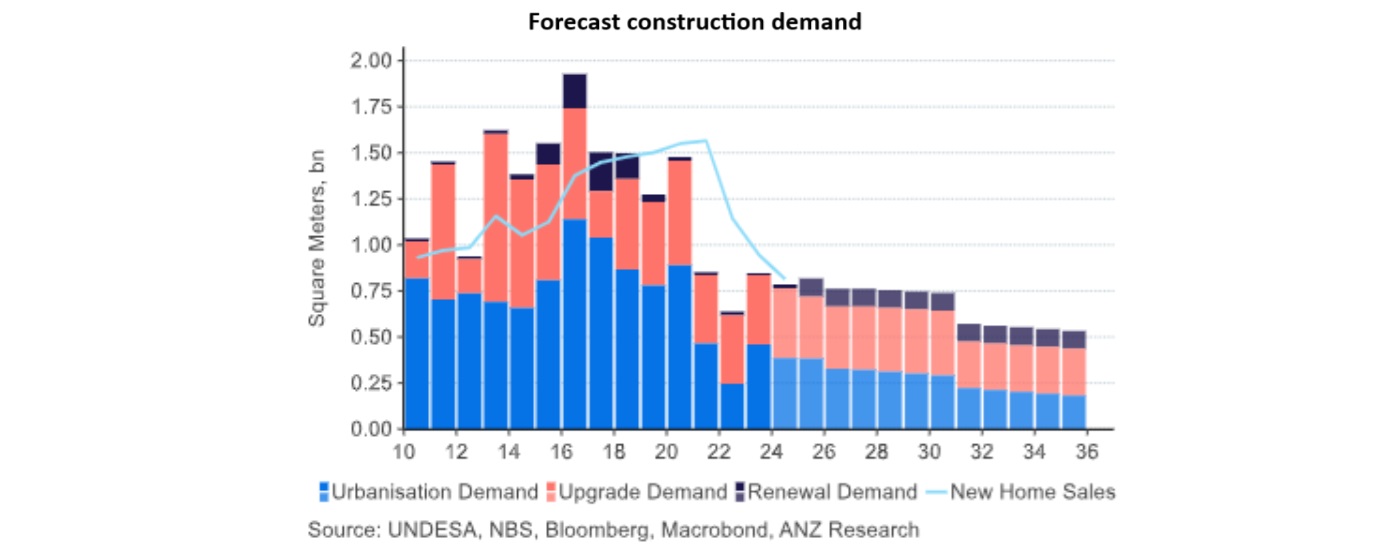

The change will be visible. ANZ Research expects Chinese property construction to decline another 30 per cent to a total of 580 million square metres by 2035. More than 50 per cent of new demand will stem from upgrading existing homes.

Property rent, rather than property prices, will be crucial to stabilise the sector, because rent will account for 75 per cent of total value added. Both migrant workers and university graduates will consistently contribute to the rental demand.

The change is a direct result of China’s vow to reform its property sector with a new development model in 2024. The new model includes a shift in the supply side from a market-led model to one led by both the market and government. The increase in affordable supply will target the working class, while the market’s commercial supply will support renovation demand.

The plan also includes a shift from pre-sales to existing home sales. Property supply will be aligned with population instead of revenue maximisation. Land sales and construction finance will be determined by the planned property supply.

Regular physical examination of property will be a pre-condition for urban renewal, and be mainly financed by homeowners and local governments.

These shifts will mark a transition from a cycle driven by credit to one driven by population. Geographically, only cities with continued domestic migration inflows or population increases can expand their property supply.

Even so, the change does not indicate the end of the cyclical downturn. ANZ Research expects the value of property as a percentage of Chinese gross domestic product (GDP) will decline by 0.8 percentage points over the next decade.

Divide

In China the divide between property construction and services is broader than places like the US or Japan.

Under China’s new model, construction will be a demand story, in which population will be the key variable. ANZ Research suspects the negative house-price outlook has squeezed out all the speculative demand.

Genuine demand is now expected to stem from property upgrades, driven by an increase in floor area per capita. In the past decade, floor area per capita in China increased by 0.5 square metres per year.

Urbanisation will also drive demand, due to the increase in residents. ANZ Research expects China’s urbanisation rate to reach 75 per cent by 2035.

Renewal due to the demolition of old buildings will also be a factor. Subscribers can read more details about ANZ Research’s estimates in the full report.

The outlook for the sector will largely depend on household confidence around income and employment. Renewal demand will remain marginal, but it could increase after 2035 as existing buildings age.

A different story

Property services include two types of activities. Leasing is valued in terms of rent, while property management and agency services are priced by commissions.

In the regions of Shijiazhuang, Jinan and Dalian, data suggest rental services accounted for about 50 per cent of property value added in 2015. More than 80 per cent of rents were ‘virtual’ — that is, the rental value of owner-occupied property.

To gauge China’s ‘virtual rent’, one can use property income and residence expenditure from the official household survey, which includes a ‘virtual rent’ estimated by the National Bureau of Statistics. Both have been increasing over the past three years.

Considering Japan's experience during its 'lost decade', ANZ Research expects China’s ‘virtual rent’ to grow at a slower pace than before. But it won’t be zero or negative.

ANZ Research estimates ‘virtual rent’ will be close to CNY5 trillion in 2025 and CNY6.5 trillion in 2035. The traditional rent market will likely grow at a faster pace.

Despite a decreasing population, the number of migrant workers and graduates in China will keep rising alongside urbanisation. New rental demand will likely increase to 15 million per year in the next decade.

ANZ Research expects China’s property market will grow to resemble that of other developed economies by 2035, when the economy is expected to reach an urbanisation rate of 75 per cent.

Property management and agency services may contribute around 10 per cent of total value, based on the numbers seen in other economies. On the other hand, the share of property construction will decline from 40 per cent to 15 per cent in the next decade.

Irreversible

ANZ Research expects the compound annual growth rate of rental services in China will be 3.8 per cent in the next decade, akin to its assumption of 4 per cent nominal GDP growth in the decade. However, construction value added will drop 2.7 per cent, on average, per year.

The shift from a construction-driven property sector to a service-like one in China will be structural. The focus of policymakers is likely to shift toward destocking and affordability.

Household income will be the necessary tool to stabilise the sector going forward, because it directly correlates with housing rent. Property prices will carry less weight in policy decisions. The importance of property in China’s economy will decline further.

ANZ Research expects property to become part of people’s livelihood security in China.

Zhaopeng Xing is Senior China Strategist at ANZ Research

This is an edited version of the ANZ Research note “China property: a structural outlook by 2035”, published June 12, 2025.

Receive insights direct to your inbox |

Related articles

-

Declining consumer confidence and spending data support ANZ Research’s forecast of no further rate rises in 2026.

2026-02-12 00:00 -

A more benign economic environment lies in store for 2026.

2026-02-06 00:00 -

The forces driving sharp shifts in the US dollar lower — as well as strength in the $S, $NZ and $A —are secular, strong and likely to be sustained.

2026-02-04 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.