-

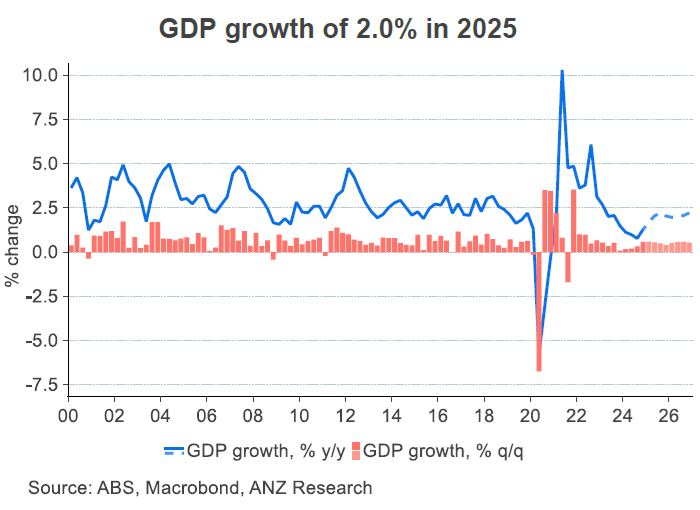

ANZ Research has downgraded its forecast for Australian gross domestic product growth, amid ongoing macroeconomic and market uncertainty.

Australia’s GDP is now expected to grow 2.0 per cent over 2025, compared to ANZ Research’s previous forecast of 2.4 per cent. For 2026, growth of 2.2 per cent is expected, compared to 2.5 per cent previously, with additional policy easing partly offsetting the impact of trade-policy disruptions and uncertainty.

A larger impact is expected in nominal GDP, with ANZ Research’s forecasts for growth over 2025 now 3.3 per cent, versus 4.1 per cent previously. This reflects higher import prices (due to a lower Australian dollar) and lower export prices (a function of weaker global growth).

ANZ Research expects trimmed mean inflation to stay within the Reserve Bank of Australia’s target band, although likely in the top half through the forecast horizon.

There are several potential offsetting impacts on inflation. Supply chain disruptions and a lower Australian dollar adds upside risk, while a diversion of Asian exports into Australia and consumer caution adds downside risk.

On a net basis, ANZ Research’s inflation forecasts are little changed from before the tariff announcements. Headline inflation will continue to be impacted by the timing of energy bill rebates.

Reassert

Confidence impacts – which have to date manifested in a stalling of confidence rather than an outright fall – should nonetheless see slightly weaker household consumption and business investment than in previous forecasts.

Ultimately, however, domestic fundamentals (particularly household incomes when it comes to consumer confidence) will reassert themselves. That in turn means policymakers can also respond to shocks to offset the impacts on both confidence and the real economy. To date, ANZ Research has expressed that policy response in additional RBA easing, with 25 basis point rate cuts in May, July and August bringing the cash rate to 3.35 per cent following the board’s August meeting.

A larger external shock could see a fiscal policy response as well. In a broader sense it’s worth remembering policy responses (as well as a lower Australian dollar) can cushion the real economy from global shocks.

The interest rate reductions anticipated by ANZ Research would see a modest lift in housing construction, although the impact on GDP growth is minor, reflecting the small size of the sector. Public demand is likely to run stronger than overall GDP growth, with slightly less of a slowing across the forecast horizon relative to previous forecasts.

While forward-looking labour market indicators, such as the ANZ-Indeed Job Ads series, stopped falling around the middle of last year, ANZ Research has lifted its expected peak in the unemployment rate (quarterly average) to 4.4 per cent from 4.2 per cent. As is typically the case in a slowdown, hours worked will soften by more than employment and limit the increase in the unemployment rate.

Adam Boyton is Head of Australian Economics at ANZ

This is an edited version of the ANZ Research report, “Macro forecast update: policy to cushion impacts of uncertainty”, published May 2, 2025

Receive insights direct to your inbox |

Related articles

-

Uncertainty around trade will constrain activity across the region, including in hiring and investment.

2025-04-29 00:00 -

ANZ Research has lifted its gold forecast amid record prices for the precious metal.

2025-04-28 00:00 -

The US tariffs’ impact on China’s growth resembles the shocks that followed COVID-19 and the global financial crisis.

2025-04-23 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.