-

The global sustainable finance market continues to slow around the world across labels, regions and industries. However, a closer look at the data shows ongoing outperformance in the Asia-Pacific region (APAC), and a handful of economies in north Asia.

Data from BloombergNEF show the volume of sustainable finance market issuances in APAC fell 6.4 per cent in the third quarter of 2023, when compared to the same quarter in 2022. However, that drop is minor when compared to the global decline of 30.7 per cent in the same period.

Issuances across north Asia (mainland China, Hong Kong, Taiwan, Japan and South Korea) fell just 1.8 per cent in the same timeframe, and on closer look, all markets in north Asia, except mainland China, experienced growth within the same period.

When compared to the second quarter of 2023, activity across those north Asian economies declined 21.4 per cent, still outperforming a 35.3 per cent global fall. However, it is worth highlighting the drop followed a 22.5 per cent rise in north-Asian second-quarter issuance when compared to the first quarter, and a 4.2 per cent global slip.

Up until recently APAC had been one of the only regions globally to record growth in the space. In 2022, north Asia recorded a 17.1 per cent rise in issuance, alongside a broader APAC rise of 11.6 per cent. The global market declined 13.9 per cent over the same period.

As a region, APAC was the second-largest sustainable-debt issuer in the nine months to September 30, 2023, accounting for 27 per cent of the total global market. Issuances in north Asia accounted for 78 per cent of total APAC issuance in the same period.

A deeper dive

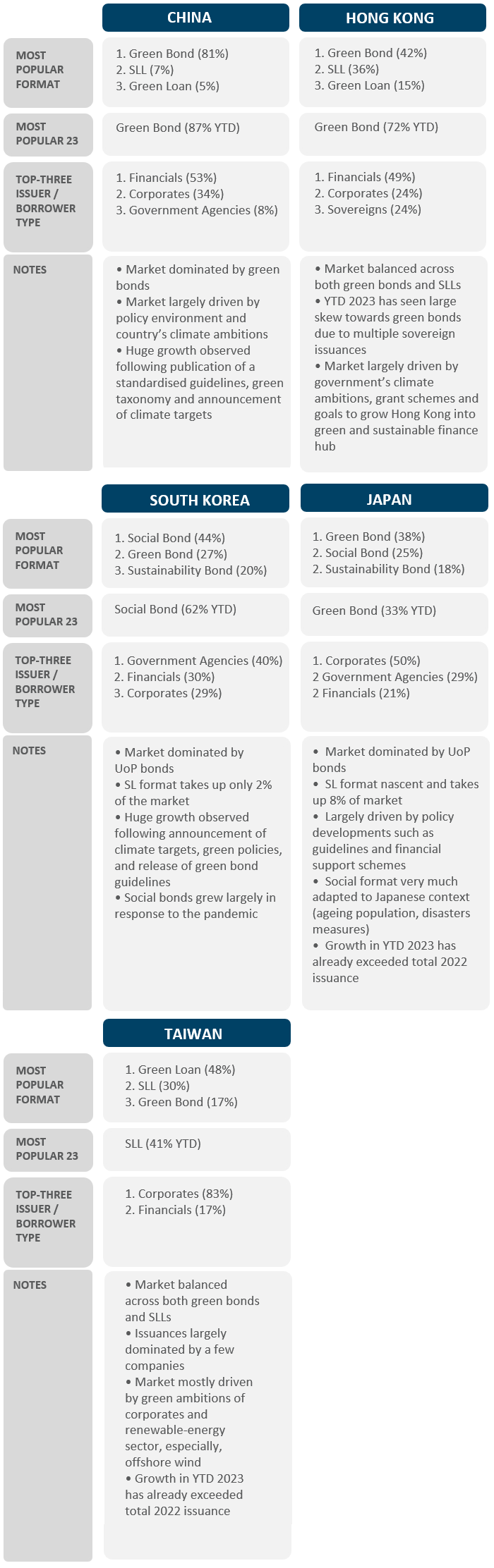

The green, social and sustainability (GSS) bond format dominates the sustainable finance market in north Asia, with green bonds being the most-popular format of issuance to date in 2023, accounting for 56 per cent of overall issuances.

Although the sustainability-linked format makes up approximately 12 per cent of the market in north Asia, it has gained momentum in recent years, specifically around sustainability-linked loans (SLLs).

SLLs are increasingly becoming more popular than green loans and was the second-largest format issued in north Asia in 2022, driven largely by demand in mainland China, Hong Kong and Taiwan.

The factors driving outperformance in north Asia are diverse and unique to each individual economy. Much can be learned from looking at how these economies have developed and supported sustainable finance, the makeup of their issuance, and the policies which have supported growth.

Mainland China

Issuances in mainland China during the third quarter of 2023 came in 44.4 per cent lower than the same quarter in 2022, showing signs of a slowdown.

Mainland China’s sustainable-finance market began to grow significantly in 2016, the earliest among markets in the region. Since then, the market has been largely driven by green bonds, which account for 81 per cent of the market to date.

Traction was first gained after a People’s Bank of China (PBOC) announcement in 2015 which provided guidelines for the issuance of green financial bonds. The Green Bond Endorsed Project Catalogue helped issuers and investors identify green projects as part of their issuances and investments.

Following the release of these landmark documents, green bond issuances in mainland China saw exponential growth, demonstrating the importance of China’s policy environment in driving the sustainable finance market. The availability of standardised guidelines and taxonomy helped to facilitate issuers entering the market and provided investors with greater clarity and confidence.

In 2020, Chinese President Xi Jinping announced China’s 2060 carbon neutrality target with the goal to peak emissions in 2030, and in 2021, China’s 14th Five-Year Plan helped set the pathway for China’s climate action. As a result, sustainable finance issuances in China surged in 2021, and SLLs began to emerge more prominently in the market.

In July 2022, China released new green-bond principles to establish a harmonised standard for domestic issuances. Green bonds currently account for 87 per cent of issuances this year, a reflection of the market’s ongoing deep appetite for green bonds.

Hong Kong

Issuances in Hong Kong in the third quarter rose 3.5 per cent compared to the same period in 2022, showing continued growth in the market despite the global decline.

Hong Kong’s sustainable finance market had a slower start compared to mainland China, taking off only in 2021 when it experienced significant growth of 287 per cent. Green bonds and SLLs account for the majority of its sustainable finance market to date.

In 2021, the Hong Kong Monetary Authority (HKMA) announced a Green and Sustainable Finance Grant Scheme to the issuance of green and sustainable debt instruments in Hong Kong. The scheme provides subsidies for eligible issuers and borrowers to cover their expenses on bond issuance and external review services. This support sparked remarkable growth within the market as observed in 2021.

In late 2021, Hong Kong published its Climate Action Plan 2050, pledging to achieve carbon neutrality before 2050, including an interim target to reduce emissions by 50 per cent before 2035 from 2005 levels. SLLs later rose 174 per cent in 2021 and 266 per cent in 2022, as companies began to disclose their climate targets and pathways to align with government ambitions.

In May 2023, the HKMA released a discussion paper on the Prototype of a Green Classification Framework for Hong Kong, aiming to seek feedback from the public on developing a green taxonomy.

Green bonds are by far the most popular format of issuance in 2023 with the total volume issued at $US14 billion so far, already surpassing 2022 total issuance of $US5.2 billion. This is largely due to the numerous sovereign green bonds issued earlier in the year.

SLL issuance, on the other hand, have softened significantly in the nine months to September 30, with total volume at $US2.1 billion compared to $US21.8 billion in 2022.

South Korea

Issuances in South Korea grew 16.9 per cent in the third quarter of 2023 compared to the previous corresponding period.

South Korea’s sustainable finance market is largely overshadowed by use-of-proceeds bonds, which makes up 91 per cent of total issuances to date. The sustainability-linked format is nascent in South Korea, accounting for less than 2 per cent of the market. Social bonds dominate the sustainable finance market in South Korea, largely due to the government’s response to the COVID-19 pandemic.

A huge spike in social bonds was seen in 2020 and 2021, largely in response to the government announcing a 50 trillion won financial support package to assist businesses and households affected by the pandemic.

Green-bond issuance grew by 843 per cent in 2021, following a slew of climate policies announced in 2020. In July that year, the Korean government announced the Green New Deal policy, the country’s national strategy to build a green economy.

In October, the country announced a carbon neutrality by 2050 ambition and an aim to reduce emissions by 24.4 per cent by 2030, compared to 2017 levels. In December 2021, South Korea disclosed its 2050 carbon-neutral strategy, as well as green bond guidelines to provide a common standard for the issuance and evaluation of green bonds within its borders.

The K-Taxonomy was published in 2021 to classify green and transition economic activities and help scale up the sustainable finance market.

Despite the release of the K-Taxonomy, sustainable finance issuances in South Korea fell by 22 per cent in 2022. That year, ANZ served as joint lead manager for both Industrial Bank of Korea’s $US600 million social bond and Shinhan Bank’s $A400 million social bond. So far in 2023, the market has favoured social bonds (62 per cent) and green bonds (25 per cent).

Japan

Sustainable finance in Japan has risen an impressive 75.3 per cent in the third quarter of 2023 compared to the same period in 2022, showing strong appetite for the sustainable finance label in the market against global decline.

Similar to South Korea, Japan’s market is also largely dominated by use-of-proceeds bonds. Green bonds account for majority of the market to date at 38 per cent while social bonds account for 25 per cent of overall issuances.

The market in Japan is driven largely by government policy developments such as the release of guidelines and support schemes. The social format of issuance is very much adapted to Japan’s context and remains a popular format in the country.

In 2017, the Ministry of the Environment of Japan developed and published the country’s Green Bond Guidelines, which was later refreshed and expanded in 2020 to be applicable to sustainable bonds. Combined with the Japanese government’s net zero by 2050 commitments, the sustainable finance market grew by 72 per cent in 2021, while green and sustainability bond issuances grew by 84 per cent and 75 per cent, respectively.

Further support from the Bank of Japan , unveiling a new scheme in 2021 to boost green and sustainable loans, pushed the sustainable finance market in Japan as it grew by 13 per cent in 2022, in comparison to the decline observed in the global market. The scheme provides “zero-interest financing to lenders supporting action to address climate change” through the issuance of sustainable finance instruments.

Social bond issuances also grew exponentially between 2020 and 2022, largely driven by government-related sectors. Social bonds in Japan are also very much focused on localised, social-related issues such as aging population and response to natural disasters. The FSA Social Bond Guidelines released in 2021 identified “disaster prevention and mitigation” and “welfare for aging population” as eligible project categories.

Japan’s sustainable finance market is demonstrating strong growth in 2023 against the slowing global market with year-to-date issuance in 2023 already exceeding 2022 total issuance. Green bonds accounted for the majority of the issuances in the nine months to September 30, 2023, at 33 per cent, followed by social bonds at 29 per cent.

Taiwan

Issuances in Taiwan in the third quarter of 2023 reached three times the volume of the same period in 2022, demonstrating very strong growth in that market. While slower to get moving, Taiwan’s sustainable finance activity has been significant in 2023.

Unlike its neighbors, the market in Taiwan is driven by the ambitions of corporates and the renewable energy sector - specifically offshore wind companies. Green loans and SLLs account for 48 per cent and 30 per cent of Taiwan’s market respectively.

Following the announcement of Taiwan’s net-zero-by 2050 target in April 2021, Taiwan’s Pathway to Net-Zero Emissions in 2050 was published, focusing on increasing wind and solar energy generation to between 40 and 55 gigawatts and between 40 and 80 gigawatts by 2050 respectively. Wind-power companies therefore constitute the majority of the green loans raised in Taiwan.

In December 2022, the FSC, the Environmental Protection Administration (EPA), the Ministry of Economic Affairs (MOEA), Ministry of Transportation and Communications (MOTC), and the Ministry of the Interior (MOI) jointly issued the Taiwan Sustainable Taxonomy. Despite the issuance of the taxonomy, SLLs remain the most popular issuance in 2023 year-to-date as it accounts for 41 per cent of the market.

Similar to Japan, Taiwan’s sustainable finance market has recorded strong growth in 2023, with issuance in the nine months to September 30 already exceeding 2022 total issuance. SLLs and green loans are the dominant format for 2023 so far, accounting for 41 per cent and 35 per cent of the market respectively. ANZ served as sustainability advisor and lender for CHIMEI’s $TW2 billion SLL in March.

The future

The strength and clarity of policy support in the north Asian region seems to be a strong factor in the growth of the sustainable finance market. There’s more work underway in this handful of economies, such as anticipated taxonomies and sovereign issuances, which could continue to provide vital support for this critical global market.

As the sustainable finance policy landscape continues to develop rapidly, coupled with increasing support from the private sector and elsewhere, it is anticipated issuance volume in north Asia will continue to grow.

Shaina Tan is Senior Manager, Sustainable Finance International at ANZ

All data presented within this article were extracted from BloombergNEF (BNEF) as at September 30, 2023. Regional and country data was extracted based on ‘region of risk’ and ‘country of risk’.

Receive insights direct to your inbox |

Related articles

-

ANZ has helped Hyundai secure sustainable funding to expand its EV manufacturing to the United States.

2023-11-30 00:00 -

The FB&A sector has an opportunity to reassess not just its impact on biodiversity - but how it can harness the value in a shift toward nature.

2023-11-30 00:00 -

Food inflation pressure looms as a risk for all sections of the Australian agriculture supply chain.

2023-11-22 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.