-

The delta variant of COVID-19 and some challenges in China have upset the global cycle. While neither seems sufficient to cause lasting damage, they both have lasting implications.

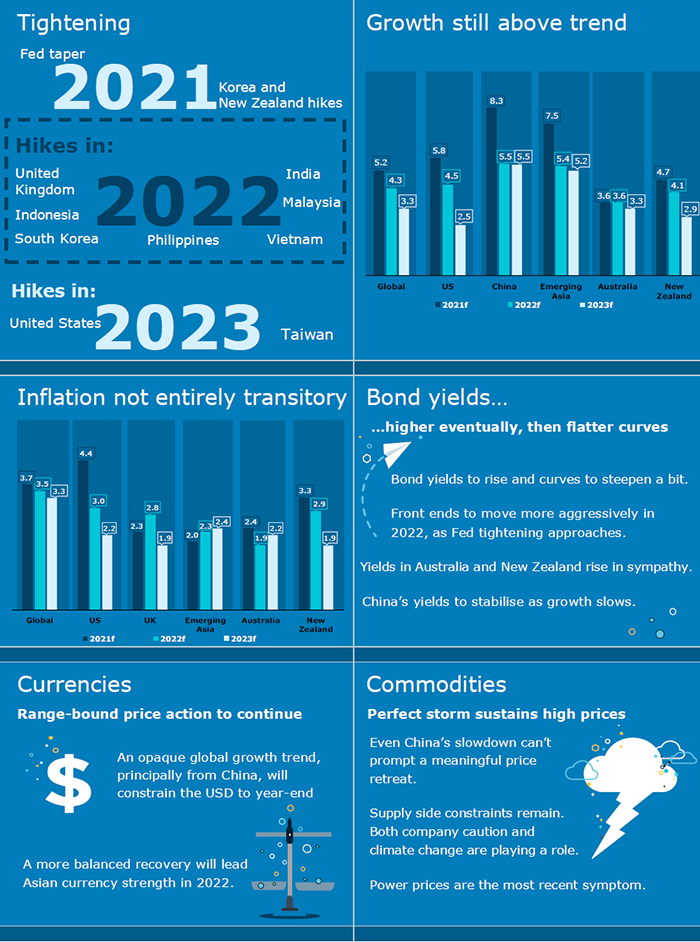

ANZ Research’s 2021 global gross domestic product (GDP) growth forecasts have come down modestly from 5.6 per cent to 5.2 per cent. Asia, Australia and New Zealand have been most impacted. But the forecast for 2022 has been upgraded to 4.3 per cent, which still implies two years of GDP growth well above the post-global financial crisis (GFC) average.

For 2023, ANZ Research’s forecast is unchanged at 3.3 per cent, in line with the post GFC average of 3.4 per cent. From a top-line GDP growth perspective, the global economy seems in good health - even if peak growth has been seen.

There are also likely to be ripple effects that are longer lasting. For one, delta seems to have settled the debate about whether COVID zero is a viable long-term strategy; it doesn’t seem to be. With asymptomatic transmission by those who are vaccinated with currently available vaccines, most of the remaining countries that have had a ‘zero COVID’ strategy have shifted to a ‘living with COVID’ one. Periodic public health measures are likely to be ongoing, suggesting delta has substantially extended the horizon of the pandemic.

China’s policy choices, and its own challenges with delta, have impacted growth materially this year. The 4 per cent ANZ Research expects for China’s growth into the close of 2021 will be the weakest in the modern period, outside the pandemic, and below the GFC low point.

Much of this slowdown reflects policy choices. While ANZ Research expects a pick-up to above 5 per cent next year, China is likely to grow more slowly over time. GDP growth in 2015 was 7 per cent, pre-COVID it had slowed to 6 per cent, and for the next couple of years 5 per cent is likely to be all that can be expected.

Episodic

While concerns around Evergrande highlights the risks around China’s economic trajectory, ANZ Research believes China’s efforts to control leverage create episodic and pocketed problems, not systemic ones. The central case in China is slower growth over time, rather than a crisis.

Much focus has been given to the policy shifts this year around climate, the tech sector, private tutoring industry, ‘common prosperity’ and other issues. These are important sectorally, but they are also important from a macro perspective. Tech and property, particularly, have been meaningful contributors to China’s GDP growth. Constraints on their activities will have a growth cost, at least in the short term.

This is the first cycle since at least before the GFC that an easing cycle in China hasn’t resulted in strong property price rises. For some years China has suggested the property sector and stabilising the level of debt as a share of GDP are policy targets, but this is the first period in which the effort has been so overt.

ANZ Research expects this stance towards the property sector to be in place for at least the next few years. Ideally, slower growth in property credit will result in faster growth in other, more productive, credit. This presupposes, however, the lack of gains in real estate prices don’t impact the propensity of households to borrow and spend. And the slower activity in the housing sector doesn’t negatively impact the demand for credit in other parts of the economy.

With housing-linked credit accounting for around 30 per cent of bank lending in China, and housing accounting for 70 per cent of household wealth, these assumptions seem heroic.

The cross country historical experience also seems clear. Where credit growth goes, so goes nominal GDP growth. China has recorded very strong growth on both measures for quite some years. ANZ Research expects a continued reversion toward the global mean. The experience of Australia is that constraining housing credit at the end of a very long boom has meaningful impacts on economic growth, as other sources of credit demand fail to fill the gap.

Policy

With global growth fundamentals still quite positive even with these challenges, the bias on policy in many economies will be towards restricting policy stimulus rather than adding more. China is the key exception to this, where the restrictive stance towards credit is likely to be tempered with efforts to ensure the landing is measured. Rate cuts are unlikely, but selective RRR cuts and other targeted measures should be anticipated.

With the exception of NZ, where policy settings seem most stimulatory, tightening steps are likely to be measured and cautious. ANZ Research expects the Bank of England to end quantitative easing this year; and the Fed to start tapering before year-end, with rate hikes not likely until the second half of 2023.

NZ is likely to be the only rate hiker in calendar 2021, other than Korea, which has already moved. The UK, India, Indonesia, Malaysia, Philippines and Vietnam are likely to follow next year, Thailand and Taiwan in 2023 and Australia in 2024. ANZ Research does not foresee any movement from the European Central Bank in that period.

Inflation is where the most uncertainty remains. Many of the preconditions for a sustained rise in global inflation remain in place: tight labour markets, skills shortages in a range of sectors, high commodity prices, elevated inflation expectations, central bank permissiveness, and supply chain adjustments reflecting reshoring, geopolitics and other influences are common themes across economies. ANZ Research thus doesn’t view the current spikes in inflation as entirely transitory. Upside surprises are continuing.

Wages, however, are patchier. In the US the trend to higher wages seems reasonably well entrenched. Elsewhere the evidence is not as clear.

Into the close of 2020, ANZ Research thought a taper tantrum was likely this year. A genuine taper tantrum, as opposed to just a more standard positioning adjustment, will likely require either a more abrupt shift in policy than we forecast or a stronger financial boom ahead of the tightening ANZ Research expects.

Richard Yetsenga is Chief Economist at ANZ

This story is an edited excerpt from ANZ Research Quarterly: adjustment only, published September 28 2021. Click HERE to read the full document.

Related articles

-

ANZ Research has upgraded its India forecast, but the economy may still miss its potential.

2025-07-03 00:00 -

The $US is shifting form, and recent depreciation is likely to be the new normal.

2025-06-18 00:00 -

A new approach to asset financing is building equity in First Nations suppliers to the mining industry. First Nations procurement targets in other industries could be met with a similar approach.

2025-06-10 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.