-

Published April 27 2021

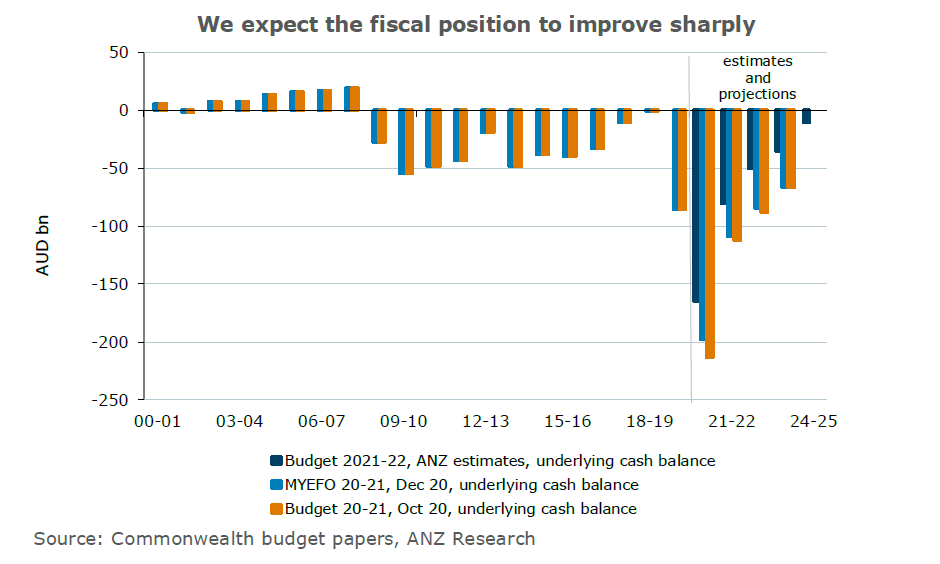

A much stronger economic outlook for Australia is likely to see a sharp improvement in the fiscal position in the 2021-22 Australian Federal budget.

ANZ Research expects the deficit to be somewhere around $A40 billion lower in 2021-22 compared with the Mid-Year Economic and Fiscal Outlook (MYEFO) and about $A130 billion lower over the four years from 2020-21.

Policy movements will moderate the scale of the improvement. ANZ Research expects the Australian Federal Government to spend more and cut taxes, with the budget including new policy decisions worth around $A10 billion in 2021-22 and around $A40 billion over the four years from 2020-21.

Though this spending will be dwarfed by improvements in the economic outlook, providing an expected improvement of about $A170 billion over the same time.

One meaningful policy decision is likely to be the extension of the low-and middle-income tax offset, which is currently set to expire in 2020-21. There will also be important spending announcements in areas such as aged care.

The net debt forecast is likely to reach about $A750 billion in 2021-22 or 37 per cent of gross domestic product, quite a bit lower than the 39.3 per cent estimated at MYEFO.

ANZ Research expects net debt to peak at around $A875 billion compared with the $A950 billion expected at the time of MYEFO. Though still quite a bit lower, this is easily a historic high.

The much-improved fiscal position is likely to mean debt issuance is commensurately lower.

Drivers

The materially better-than-expected economic data since December’s MYEFO is likely to be the main driver of changes in the budget’s forecast fiscal position. The speed and degree of improvement was already evident between the October budget and MYEFO, with the underlying cash deficit from economic parameter variations shrinking by around $A36 billion. This was particularly notable given MYEFO came out only a couple of months after the budget, which was delayed by the pandemic.

Since MYEFO, Australia’s fiscal position has improved as the economy’s performance drove payments down and tax collections up. Based on the latest data, the deficit in 2020-21 is already $A23 billion smaller than the MYEFO forecast for the three months from December to February.

It seems inevitable the budget’s forecasts will be much better than the MYEFO’s, when the government was forecasting an unemployment rate of 7.25 per cent in June 2021, falling to 6.25 per cent by the end of 2021-22.

With the unemployment rate already at 5.6 per cent and the end of existing policy support unlikely to cause a sustained material rise, the budget is likely to include a much better labour market outlook.

This alone will materially lift the budget forecasts, as the labour market affects both unemployment benefits and individuals’ tax receipts (which is the largest revenue source).

It is worth noting that the budget is also likely to include stronger goods and services tax (GST) forecasts, given the strength of the economy. This can be seen in collections data, with GST receipts currently $A5.9 billion stronger than expected at MYEFO.

However, the net impact from this on the budget is neutral given the federal government pays GST to the states and territories. Nevertheless, this will be supportive for state/territory fiscal positions, which will also see significant upward revisions when they announce their 2021-22 budgets.

It’s unlikely, at this stage, delays in the COVID-19 vaccine rollout will cause material adjustments to the economic and fiscal forecasts. Despite significantly hitting some sectors and businesses, it probably won’t disrupt the overall economic recovery.

Big ticket

ANZ Research thinks the likely ‘big ticket’ items in the budget will be aged care and tax cuts. No doubt there will be targeted spending in other areas, but the government will likely want to show a solidly improving fiscal position over the forward estimates.

The most likely area to see a large policy announcement will be in personal tax, an important feature of this government’s fiscal policy. Though there are a range of options available, the most likely is a further extension of the low- and middle-income tax offset (LMITO), currently set to expire in 2020-21.

The offset was introduced in Stage 1 of the 2019-20 budget as part of the Personal Income Tax Plan and extended to include 2020-21 last year.

Depending on an individual’s income level, the offset is worth between $A255 and $A1,080. Treasury has previously estimated the policy costs more than $A7 billion per year. ANZ Research thinks it will likely be extended for only one year, but it is also possible it may become a permanent feature.

Healthcare is another area likely to see considerable expenditure. The government has announced an aged-care package worth more than $A10 billion over the next four years.

In addition, the further 20 million doses recently ordered of the Pfizer vaccine will cost over $A500 million. It also looks like there will be support provided for domestic companies for vaccine production to help combat future pandemics. And expect additional spending on mental health.

There is also likely to be a range of smaller policy announcements. Similar in size to policies like the clean-energy funding package, which will be a little over $A500 million over four years, and the tourism package, worth $A1.2 billion. Additional support for childcare is another target for more spending.

All up, ANZ Research assumes policy decisions will total around $A10 billon in 2021-22, noting the extension of the LMITO will hit the fiscal numbers in 2022-23 not in 2021- 22, and about $A40 billion over the four years from 2020-21. If the extension of LMITO is permanent, the hit would be over $A60 billion.

Hayden Dimes is a Market Economist and David Plank is Head of Australian Economics at ANZ

This story is an edited version of an ANZ Research note. You can read the original note HERE.

Related articles

-

The $US is shifting form, and recent depreciation is likely to be the new normal.

2025-06-18 00:00 -

A new approach to asset financing is building equity in First Nations suppliers to the mining industry. First Nations procurement targets in other industries could be met with a similar approach.

2025-06-10 00:00 -

The road to normalisation in the world’s largest bilateral trading relationship looks complex.

2025-05-28 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.