-

Market update

Market figures

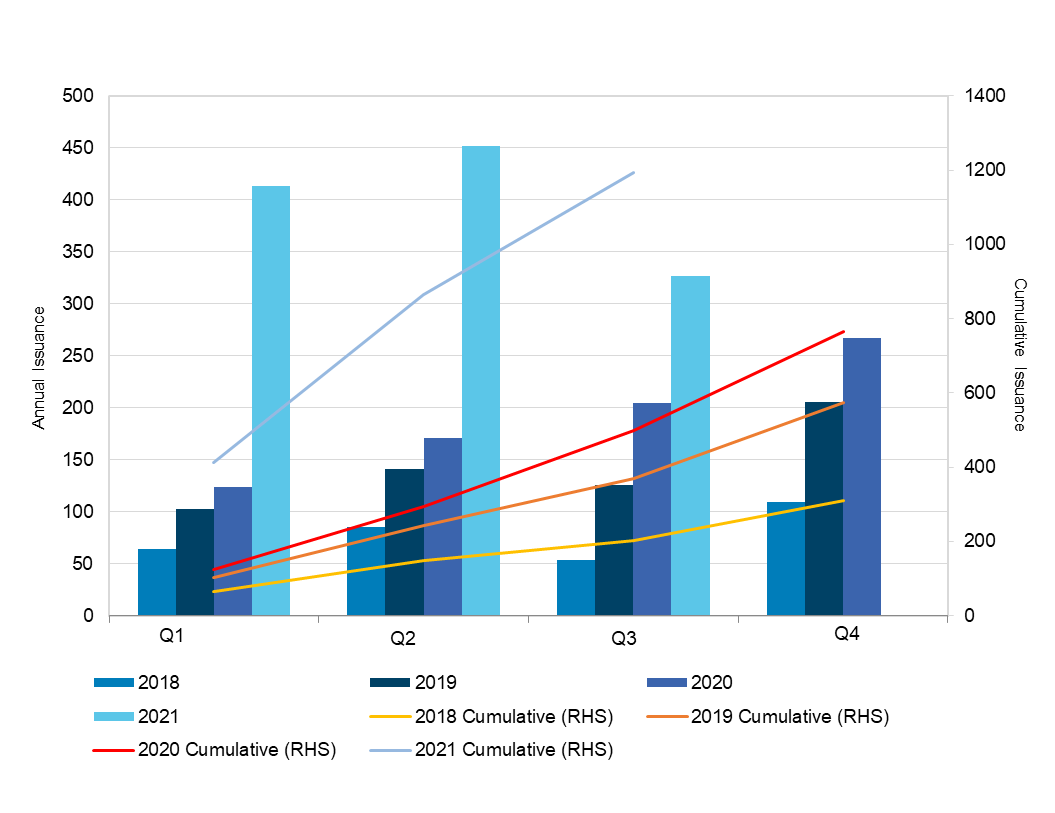

- Global issuance of Sustainable Finance debt YTD in 2021 now totals USD1.19tr, surpassing last year’s full year issuance of USD760bn. Q3 Environmental, Social and Governance (ESG) issuance totalled USD327bn, easing off from the first two record breaking quarters of 2021 (Q1 USD413bn and Q2 USD452bn1), but remaining significantly higher than 3Q2020 at 205bn. The total global Sustainable Finance debt market now exceeds USD3.5trn.

- 3Q2021 key figures (ordered highest to lowest):

- USD151bn of Green Bonds, USD46bn higher than 3Q2020 at USD105bn, USD4bn higher than 2Q2021 at USD147bn

- USD56bn of Sustainability-Linked Loans (SLLs), USD36bn higher than 3Q2020 at USD20bn, USD84bn lower than 2Q2021 at USD140bn

- USD46bn of Sustainability Bonds, USD15bn higher than 3Q2020 at USD31bn, USD12bn lower than 2Q2021 at USD58bn

- USD36bn of Social Bonds, USD6bn higher than 3Q2020 at USD30b, USD20bn lower than 2Q2021 at USD56bn

- USD24bn of Sustainability-Linked Bonds (SLBs), USD20bn higher than 3Q2020 at 4bn, USD11bn lower than 2Q2021 at USD35bn

- USD13bn of Green Loans, USD2bn lower than 3Q2020 at USD15bn, USD4bn lower than 2Q2021 at USD17bn

Global Sustainable Debt Market by Year and Product (USD billions)

Source: Bloomberg, 30 September 2021

Global Sustainable Debt Market by Year and Quarter (USD billions)

Source: Bloomberg, 30 September 2021

[1] Past figures in this report may differ from those quoted in previous reports as all figures are based on BNEF data which is retrospectively updated when new deals are identified from prior periods.

Market insights

- Green Bonds continue to dominate making up 46% of total 3Q2021 issuance, the only GSSS format that did not drop in volume, compared to Q2. This compares with Green Loans which now make up the smallest percentage of sustainable finance issuances at 4% of total 3Q2021 issuance. Green Bond dominance can be partly attributed to the rise of sovereign and semi-government issuances. For example:

- The UK Debt Management Office issued its GBP10bn 12.5-year transaction inaugural Green Bond, which claimed the “largest sovereign greenium” of 2.5bps at the time of issuance. This is the largest ESG bond issuance by a sovereign, and the largest ever order book on a sovereign green bond (over GBP100bn). Indonesia, Spain and the Isle of Man also issued inaugural GSSS Bonds and Serbia, Chile and Germany expanded existing programs.

- Queensland Treasury Corporation (QTC) completed its March 2032 AUD3bn Fixed Rate Green Bond (ANZ as Joint Lead Manager (JLM)), and Treasury Corporation of Victoria completed its debut, AUD2.5bn September 2035 Sustainability Bond (ANZ as Sustainability Bond Co-ordinator & JLM). Comparing the secondary market asset swap spreads on QTC’s ESG lines to the yields on benchmark bonds reveals an ESG premium.

- Although SLL issuances have reduced compared to last quarter’s record issuance, they represent the second largest proportion of the market, at 17%, and maintain momentum with issuances in 3Q2021 almost three times that of 3Q2020. Example transactions in the past quarter include:

- Supermarket operator Coles completed a AUD1.3bn SLL, the first Australian supermarket operator to do so, with three sustainability targets related to reducing Scope 1 and Scope 2 emissions, increasing total waste diverted from landfill, and increasing the percentage of women in leadership roles. ANZ was Joint Sustainability Coordinator, Mandated Lead Arranger (MLA) and Bookrunner.

- China’s state-owned agri-business company COFCO International announced a USD700m 3-year SLL, with targets relating to the traceability and socio-environmental screening of Brazilian soy supplies and Sustainalytics ESG Management rating. ANZ acted as Joint Sustainability Coordinator.

- Retirement village operator Summerset Group completed a NZD700m equivalent multi-currency SLL, becoming New Zealand’s largest SLL transaction. Targets relate to: the roll out of memory care suites and the continuation of dementia friendly accreditation; an emissions reduction target; and a reduction in construction waste to landfill. ANZ was Sole Sustainability Coordinator and Sole Arranger

- Sustainability Bonds and Social Bonds represent the third and fourth highest percentage of 3Q2021 issuance at 14% and 11% respectively. While volume figures represent a drop since Q2, they are significantly higher than 3Q2020. This growth reflects increasing investor conversations about social impacts. COVID-19 has highlighted and amplified inequalities and, alongside movements such as Black Lives Matter, has increased interest in social bonds as well as social targets for linked products. Challenges continue such as less standardisation and fewer clear benchmarks to assess credibility.

- SLBs continue to accelerate. Despite a drop from Q2, 3Q2021 issuance is almost seven times higher than 3Q2020 and 2021 SLB issuances make up 81% of total SLB issuances in the market to date. Example transactions in the past quarter include:

- Supermarket operator Woolworths’s inaugural EUR550m 7-year SLB. Targets relate to 1.5-degree aligned Scope 1 and 2 emissions reductions as verified by the Science Based Target Initiative (SBTi) with a 25bps step up for the remainder of the tenor for failure to meet targets, triggered 2 years before maturity.

- Global food and agri-business Olam priced a privately placed JPY5.5bn 5-year SLB, its second sustainability-linked issuance following its debut in December 2020 (also ANZ-led), which was the first SLB in Asia (ex-Japan). Issued at a fixed coupon of 1.403% with a step-down adjustment linked to targets relating to Olam’s three Purpose outcomes: Prosperous Farmers and Food Systems; Thriving Communities; and Regeneration of the Living World. ANZ was Sole Manager, Swap Dealer and Sustainability Structuring Advisor.

- Climate Bond Initiative’s (CBI) recent study shows increasingly high demand for sustainable finance products has led to consistent oversubscription, higher than average book sizes, greater spread compression and competitive pricing, culminating in “greeniums” where ESG labelled issuances are priced below vanilla debt with additional discounts for linked products. Greeniums of 5 bps are observed in Europe and some individual transactions estimate greeniums of up to 25 bps discount. Stable greeniums are predicted for the Australian dollar market as it continues to develop and demand continues to outstrip supply.

- Transition finance has mixed reviews. Transition labelled products are attractive for the hard to abate sectors, such as oil, gas and shipping, as a way to attract capital and avoid greenwashing accusations. Some investors are disinterested, given strict ESG mandates which exclude companies involved in fossil fuel value chains and concerns the products allow business as usual emission trajectories as well as a lack of clear principles to ensure integrity and standardisation (notwithstanding the ICMA Climate Transition Handbook). Others believe the product is required to help brown companies go green and transactions continue to occur with strong investor interest. Japanese shipping company NYK Line issued the first transition bonds in the Japanese market comprising of a five and 7-year tranche of JPY10bn each, and priced at 0.26% and 0.38% with books reaching JPY95bn respectively. A recent 2021 investor survey shows 84% are ‘very keen’ or ‘open to’ brown-to-green instruments and the proportion of investors interested in transition products has doubled since 2020. See CBI guidance to avoid greenwashing in transition financing.

- New innovative products are forever increasing demonstrating desires to leverage the full financing spectrum for positive impact. Past quarter examples include:

- ANZ supported a design and construction company issue a Green Guarantee in Hong Kong, in relation to an underlying eligible green asset which fulfils pre-determined Sustainable Finance criteria aligned to the Green Loan Principles. ANZ was Sustainability Coordinator.

- Asian Development Bank issued a dual tranche ‘blue’ bond via private placement, a 10-year AUD208m tranche and 15-year NZD217m tranche, to finance ocean-related sustainable projects in the Asia-Pacific region including the reduction of waste to oceans via a waste-to-energy project in the Maldives and river ecological protection in China. The bonds were privately placed with Meiji Yasuda Life and Dai-ichi Life, respectively.

Emerging trends

Global activity

- In the lead up to COP26 in October 2021, many companies and countries are releasing updated emissions targets, putting pressure on laggards. COP26 is expected to see world leaders put forward further ambitions and actions to keep 1.5 degrees in reach, with additional focus on climate change adaptation measures, nature based solutions and mobilising finance. Article 6 from the Paris Agreement, focused on enabling a global carbon market, is intended to be finalised.

- Pressure to set strong emissions reduction targets further mounts with the release of the IPCC Sixth Assessment Report highlighting the world has already experienced 1.09 degrees of warming since pre-industrial levels, with 1.5 degrees forecasted for the early 2030s based on current emissions trajectories.

- The EU released EU’s Fit for 55 package to support 55% emissions reduction by 2030, including the Carbon Border Adjustment Mechanism.

- Growing urgency and action towards protecting natural capital. Momentum will continue leading up to the UN Biodiversity Conference (COP15) which will focus on agreeing a Global Biodiversity Framework (GBF) with ambitious goals to fulfil the vision of living in harmony with nature by 2050. 78 financial institutions managing over $10tn in assets have signed a Financial Institution Statement calling for a more ambitious GBF, as reports from Banque de France, The World Bank and Swiss Re emphasise economic reliance on nature and S&P Global Sustainable analysis predicts water stress as the biggest climate hazard by 2050.

- Offsets are under the microscope with organisations facing criticisms regarding the credibility and robustness of offsets used to claim carbon neutrality or net zero. Focus likely to increase with the release of the Taskforce for Scaling Voluntary Market Phase 2 Report and establishment of a governance body focused on creating a scaled, high-integrity and efficient voluntary international offset market. Technologies are evolving to support credibility of offsets including Cyberdyne Tech Exchange’s Carbon Neutrality Token which helps to resolve the double counting challenge and provide up to date offset information through block chain technology.

- Regulators are becoming stricter on sustainability claims, with false or misleading statements made by corporates and investors potentially resulting in litigation and liability risks and therefore in regulatory fines. ASIC warns it will take regulatory action against companies making misleading net zero claims; The SEC has initiated a review into the use of green and socially conscious labels; The UK’s Financial Conduct Authority has set out a series of principles for ESG labelled funds; and The Emerging Markets Investor Alliance releases enhanced labelled bond guidelines.

- Sustainable finance heats up in the Middle-East. Saudi Arabia’s Public Investment Fund selected banks for its ESG advisory panel which will advise on an ESG framework. Saudi Arabia has also appointed banks for its sustainability financing framework and is likely to issue green bonds soon. Oman is in the early stages of an ESG framework after announcing ambitions to be ranked in the top 20 countries in the global Environmental Performance Index by 2040 (currently 110 out of 180).

APAC region

- China will no longer provide financing for new coal mining and power projects outside China. At the UN General Assembly, President Xi Jinping pledged to focus on developing green and low-carbon energy. The move has been widely applauded, given more than 70% of coal plants built today rely on Chinese funding. China has also released its Human Rights Action Plan setting out objectives and steps to protect, respect and promote human rights.

- Australia’s Treasurer Josh Frydenberg’s recent Australian Industry Group Speech highlighted the importance of achieving net zero emissions by 2050 if Australia is to avoid increasing costs of, and decreasing access to, capital, while encouraging investors to support sectors which will require financing to successfully transition. The speech comes as the NSW government commits to halving emissions by 2030 below 2005 levels, brining it in line with Victoria and South Australia.

- The BOJ announced incentives for banks to further their green loans and investments as well as plans by the central bank itself to buy green foreign currency bonds using their reserves, which could further spur demand from a key ESG investor base in the region.

- In a recent statement, the Bank of Korea (BOK) has announced plans to exclude bonds and equities issued by high carbon emitters from its USD 464 billion of foreign currency assets, while increasing its investment in companies with strong ESG performance as well as in green bonds.

- Australian senate passes bill banning imports made using forced labour. This reflects growing focus on managing ESG supply chain impacts, accelerated by the spread of modern slavery legislation; increased focus on scope 3 emissions; and COVID-19’s exposure of the lack of supply chain transparency and resilience. Organisations must invest in technology and capabilities to understand and manage impacts, develop due diligence processes, set targets and track progress.

- Australian government’s Clean Energy Regulator aims to accelerate the scale and integrity of offset markets by releasing the updated Soil Carbon method and new CCS method for generating ACCUs, as well as calling for expressions of interest to drive the emergence of an exchange traded market.

Industry focus

- The Institutional Investors Group on Climate Change, Transition Pathway Initiative and more than 20 global investors with combined assets of USD10.4trn have agreed with Oil and Gas majors, including BP, Eni, Repsol, Shell and Total, to pilot the “Net Zero Standard for Oil and Gas”. The standard outlines expectations regarding credible actions and strategies included in the net zero transition plans of oil and gas companies to improve consistency and comparability.

- The food, beverage and agriculture (FBA) sector has received much attention this past quarter, with a number of reports outlining the importance of, and detailed guidance for, managing ESG impacts. This includes the World Benchmarking Alliance’s recent Food and Agriculture benchmark which finds the sector is off track to a sustainable food system; Finance for Biodiversity Initiative’s sustainable food system report which explores how to align global food and financial for a sustainable food system; as well as Climate Action 100+’s food and beverage report, Ernst & Young’s agriculture report and the Grattan Institute’s agriculture report, all of which lay out actions towards net zero for the sectors.

Investors

- Shareholders demand credible climate change action with companies facing shareholder resolutions and legal action for not doing so. Origin joins other energy companies including AGL, Santos, Rio Tinto, Woodside, Glencore, Shell and Anglo American in putting climate change plans to advisory shareholder votes in 2022.

- A record number of 587 investors with USD46trn in assets under management sign the 2021 Global Investor Statement to Governments on the Climate Crisis, urging governments to raise their climate ambition and implement meaningful policies or risk missing out on enormous investment in tackling the climate crisis.

- Carbon Disclosure Project (CDP)’s 2021 Science Based Target Campaign is the world’s largest investor engagement campaign. It includes 220 global financial institutions, across 26 countries and holding USD29.3trn in assets, calling on 1600 of the world’s highest impact companies, with a market capitalisation of over USD41trn and representing 11.9 gigatons of scope 1 and 2 emissions, to urgently set 1.5-degree aligned emissions reduction targets through SBTi.

- CDP collaborates with investors worth USD2.3trn of assets to create the first standardised environmental disclosure platform for private markets. The platform will allow investors to benchmark private companies and compare environmental performance. The move intends to overcome the historical lack of transparency for private companies and the risk of diminishing transparency associated with the trend towards privatisation of high-carbon assets.

Reporting and taxonomies

- More countries plan to implement mandatory TCFD reporting, including Switzerland from 2024, joining France (2021), the UK (2022) and New Zealand (2023), among others, after the G7 countries endorsed mandatory TCFD disclosures in June. The SEC announces development of a mandatory climate risk disclosure rule proposal for consideration by the end of 2021, and releases a Sample Letter to send to companies with insufficient climate disclosures requiring further detail.

- The Taskforce for Nature Related Financial Disclosures (TNFD) announces taskforce members and launch of consultative forum, leveraging global nature and finance expertise to drive work on the TNFD framework. More than 100 institutions have signed up to provide support through the forum, including ANZ.

- Publication of: Draft EU Environmental Taxonomy technical screening criteria covering the four non-climate-related environmental objectives of water resources, circular economy, pollution prevention and biodiversity; Draft EU Social Taxonomy looking at the structure for a social taxonomy; and the Public Consultation Report on Taxonomy extension options ‘beyond green’ including significantly harmful activities and no significant impact activities.

- Companies will be required to provide forward looking disclosures as well as retrospective information under the EU Corporate Sustainability Reporting Directive Climate standard prototype published by The European Financial Reporting Advisory Group.

- Innovations in sustainability reporting including increasing use of technologies such as block chain, the Internet of Things and remote sensing for improved data gathering and analysis. For example, the recently launched Climate TRACE leverages satellites, remote sensing, artificial intelligence and machine learning to independently measure greenhouse gas emissions and fill the gaps left by current emissions reporting.

Sustainable finance industry updates

- The Australian Sustainable Finance Initiative has been converted into a private company, the Australian Sustainable Finance Institute (ASFI), to drive and coordinate the delivery of the Australian Sustainable Finance Roadmap. ANZ’s Head of Sustainable Finance, Katharine Tapley, has been appointed as one of three founding board directors.

- International Chamber of Commerce publishes Sustainable Export Finance Whitepaper at the UN General Assembly. ANZ co-led the Sustainability Working Group for this initiative over the last 3 years. It sets out recommendations and a roadmap to “boost the sustainability profile of the export finance market”.

- CBI launches new sector criteria for Electrical Grids & Storage which applies to transmission, distribution and storage of electricity and lays out the specific requirements that grid and storage assets and/or projects must meet to be eligible for inclusion in a CBI certified green instrument.

- Sustainalytics now allowing combined Use of Proceeds and Sustainability Linked Frameworks with 2-year validity periods on all second-party opinions (SPOs) and has adopted the ICMA Climate Transition Finance Handbook criteria for transactions in the hard to abate sectors.

- S&P Global Ratings launches SPO offering for Sustainability-Linked Financing.

ANZ updates

- ANZ now has approval to issue Green Guarantees and Sustainability Linked Guarantees. Alongside ANZ’s Sustainability Linked Derivative and Sustainable Supply Chain Finance, these products represent the bank’s commitment to innovation.

- ANZ Sustainable Finance welcomes Kate Gunthorp who joins us as a Director in Auckland from ANZ’s Loan & Markets Execution team, and Ivan Ng who joins us as a Senior Manager in Melbourne from ANZ Group Treasury.

As we go to print – what we couldn't wait to talk about!

- EU’s EU12bn NGEU Green Bond debut receives huge demand, setting records for the largest green bond in the world and the largest ever overbook for a green bond. The EU green bond overshadows the UK’s inaugural green trade noted above in terms of both size and demand. The trade received bids of EUR120bn within an hour, with the final order book reaching EUR135bn. The deal highlights the advantage of green funding, with the transaction pricing with a “greenium” of 2.5bps.

- RBA Deputy Governor Guy Debelle’s recent speech highlights: climate change is a first-order financial risk; APRA’s Climate Vulnerability Assessment of Australia’s five largest banks will assess physical and transition risk exposures and provide useful data and methodologies for other financial institutions; climate disclosures are rising with 80 of the ASX top 200 companies undertaking voluntary climate disclosures under TCFD and ASIC encouraging more of this practice; the need for an Australian specific taxonomy to define sustainable activities; the effective increasing cost, and decreasing ease, of access to capital for emissions-intensive activities; and marked opportunities for Australia to be a leading exporter of renewable energy.

- The Global Reporting Initiative (GRI) has updated the GRI Universal Standards, which consist of GRI101: Management Approach 2016, GRI102: General Disclosures 2016, and GRI103: Management Approach 2016 to improve quality and consistency of reporting, and updated GRI11: Oil and Gas Sector 2021 to support the sector in meeting complex transparency demands including present day impacts and transition plans. Both updates come into effect 1 January 2023.

- ASFI has announced the appointment of Kristy Graham as its inaugural Executive Officer, due to start 15 November 2021.

- ANZ joins Net-Zero Banking Alliance and the Glasgow Financial Alliance for Net Zero which bring together banks worldwide committed to accelerating economic decarbonisation and aligning lending and investment portfolios with net-zero emissions by 2050.

ANZ contacts

ANZ has a global Sustainable Finance Team with presence in Sydney, Melbourne, Singapore, Hong Kong, London and New Zealand.

Feedback and enquiries can be directed to sustainablefinance@anz.com.

Australia

Katharine Tapley

Head of Sustainable Finance

T: +61 2 8937 6092

E: Katharine.Tapley@anz.com

Based in Sydney

Emily Tonkin

Executive Director, Sustainable Finance

T: +61 2 8937 8454

E: Emily.Tonkin@anz.com

Based in Sydney

Bronwyn Corbet

Executive Director, Sustainable Finance

T: +61 419 415 343

E: Bronwyn.Corbet@anz.com

Based in Melbourne

Tessa Dann

Director, Sustainable Finance

T: +61 2 8037 0602

E: Tessa.Dann@anz.com

Based in Sydney

Andrew Brown

Director, Sustainable Finance, Capital Markets

T: +61 4 6602 9172

E: Andrew.Brown4@anz.com

Based in Sydney

Tania Smith

Director, Sustainable Finance

T: +61 3 8655 1655

E: Tania.Smith@anz.com

Based in Melbourne

Jo White

Director, Sustainable Finance

T: +61 2 8937 6062

E: Jo.White@anz.com

Based in Sydney

Katie Wood

Associate Director, Sustainable Finance

T: +61 4 5994 9710

E: Katie.Wood@anz.com

Based in Melbourne

Kate Cheeseman

Senior Manager, Sustainable Finance

T: +61 2 8937 6590

E: Kate.Cheeseman@anz.com

Based in Sydney

Jessica Liu

Manager, Sustainable Finance

T: +61 4 3492 4546

E: Jessica.Liu@anz.com

Based in Sydney

New Zealand

Dean Spicer

Head of Sustainable Finance, New Zealand

T: +64 4 3819884

E: Dean.Spicer@anz.com

Based in Auckland

Kate Gunthorp

Director, Sustainable Finance

T: +64 9 2526122

E: Kate.Gunthorp@anz.com

Based in Auckland

Caroline Poujol

Director, Sustainable Finance

T: +64 21 619 532

E: Caroline.Poujol@anz.com

Based in Auckland

Poppy Brinsley

Analyst, Sustainable Finance

T: +64 2 7844 7095

E: Poppy.Brinsley@anz.com

Based in Auckland

International

Stella Saris Chow

Head of Sustainable Finance, International

T: +65 6708 2896

E: Stella.Saris@anz.com

Based in Singapore

Stephanie Vallance

Director, Sustainable Finance

T: +65 6708 2839

E: Stephanie.vallance@anz.com

Based in Singapore

Mara Chiorean

Director, Sustainable Finance

T: +65 8328 1532

E: Mara.Chiorean@anz.com

Based in Singapore

Nancy Wang

Director, Sustainable Finance

T: +852 6595 3762

E: nancy.wang3@anz.com

Based in Hong Kong

Prash Odhavji

Senior Manager, Sustainable Finance

T: +852 3917 7307

E: Prash.Odhavji@anz.com

Based in Hong Kong

Kaitlin Edwards

Senior Manager, Sustainable Finance

T: +44 2032 292601

E: Kaitlin.Edwards@anz.com

Based in London

Related articles

-

The ultimate goal of sustainable finance markets is to become the main avenue to access investor capital, according to participants at a recent roundtable organised by ANZ and FinanceAsia.

-

LISTEN: ANZ experts Katharine Tapley and Paul White discuss the increasing ESG focus from investors.

-

As China focuses on sustainable growth, it makes economic sense to reduce carbon emissions in the long run.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.