Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

![]()

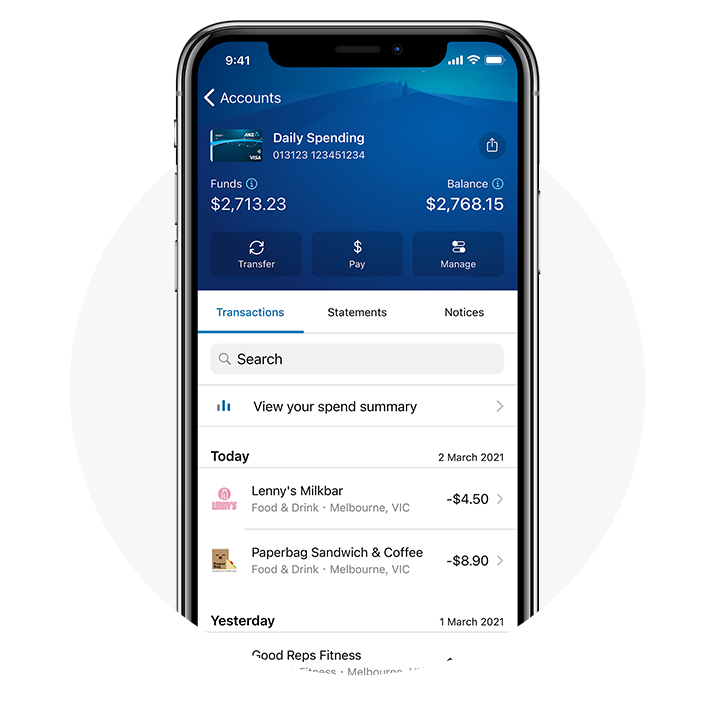

Message us anytime to connect to a banker, with your identity already confirmed.

Rest easy with 24/7 support and biometric security features like Voice ID tailored just for you.

![]()

Download the ANZ App to get started on your mobile device.

![]()

Tip: Before you begin, you will need to register for online banking.

Make payments to your friends and family, create a PayID® to get paid faster and schedule future payments and recurring payments.

Easily view detailed transactions and statements, get personalised insights and saving tools,disclaimer plus organise spending by merchant or category.

Activate your card and manage your PIN. Quickly add a temporarily block, or report it lost or stolendisclaimer and instantly arrange a replacement card. Go cardless with a digital wallet.

See your home loan at a glance with the ANZ App. View your interest rate, check your next repayment, plus track the progress on your loan from anywhere. Nice!

It’s banking built with everyone in mind. Hear your balances and make transfers or payments with VoiceOver and TalkBack. Change the font size in ANZ App with Dynamic Type.

The ANZ App simplifies banking for business.

Get a clear view on where your business is at, separate to your personal account. Stay on top of your cashflow with real-time notifications for money going in and out. Plus, use your mobile, ABN or ACN as your PayID® to make it easier for customers to pay you quickly.

Open a new business account in the ANZ App in just minutes, using your driver’s licence or passport, and ABN.disclaimer

Download the ANZ App from the Australian App Store or Google Play before you go away as you may not be able to download it outside of Australia. If you already have it installed, it’s also helpful to ensure you’ve updated to the latest version before you go.

Even with international roaming enabled, you may not be able to receive SMS messages required to register, or to reset your login details.

The ANZ App will work overseas if you have access to a secure internet connection and you can also manage your money in ANZ Internet Banking. While you’re away, Message us in the App is the easiest way to contact us if you need assistance.

We recommend you also visit our Travelling Overseas page for any helpful information.

It’s important to keep your operating system and the ANZ App up to date to ensure that you receive security updates and feature improvements. How you update might change depending on which device you're using, so we've added some step-by-step instructions here.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks of Google Inc.

PayID is a registered trademark of NPP Australia Limited.

Available on ANZ Online Saver and ANZ Progress Saver accounts.

ReturnIf you think your card is lost or stolen, it's important that you let us know immediately.

ReturnConsider if right for you. Eligibility criteria, terms and conditions apply. Fees and charges apply. See anz.com for more.

Return