Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

ANZ is committed to deepening the understanding of financial wellbeing in Australia and New Zealand by producing an academic survey every three years, informed by the latest international research.

The following targets have been introduced in 2024, to extend work underway in our focus areas:

More information about performance against our 2023 targets and our full suite of 2024 targets are available in our ESG reporting.

The 2021 Financial Wellbeing Survey represents an evolution in how we examine financial wellbeing, drawing on the work of Professor Elaine Kempson et al. and developments in international research and practice in measuring and improving people’s financial wellbeing since 2017.

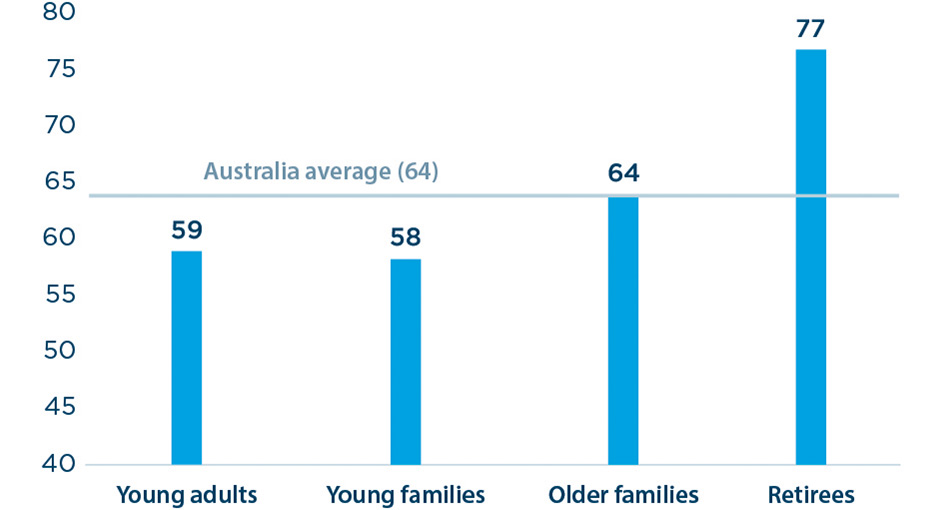

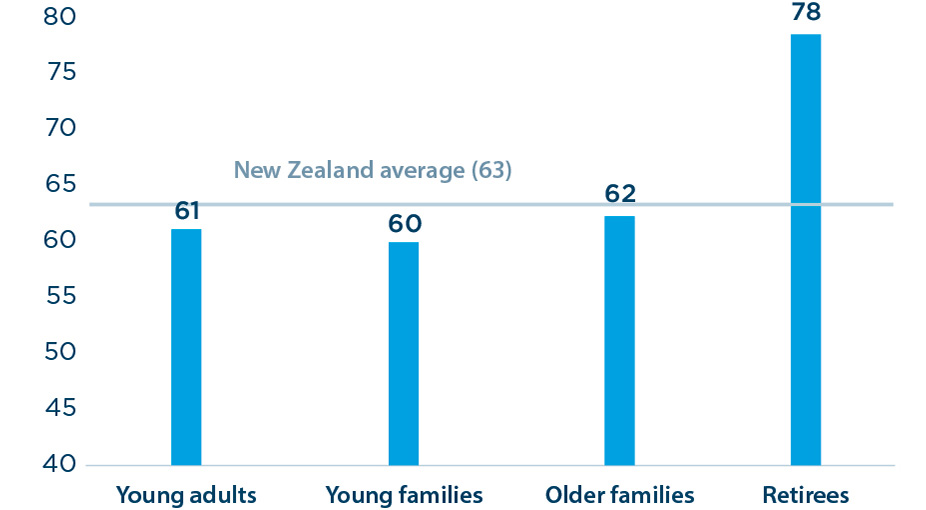

The latest reports set out insights from the survey measuring the financial wellbeing of more than 5,000 adults in Australia and New Zealand. The survey is the seventh in a series of comprehensive surveys that ANZ has conducted in Australia since 2002 and New Zealand since 2017.

This 2021 Financial Wellbeing Survey highlights the significant role that a person’s socio-economic context and their behaviour traits play in influencing their financial wellbeing.

The 2021 research also showed that in addition to their ability to meet everyday commitments, how comfortable they feel about their financial situation and their resilience to sustain financial shocks, whether people were ‘feeling secure for the future’ was a key fourth component of measuring financial wellbeing. The financial wellbeing scores were derived from measures for four components of financial wellbeing:

How well people meet their current expenses

How comfortable people feel about their current financial situation (next 12 months)

The ability to cope with financial setbacks

A long term view of future financial security

2021 Adult Financial Wellbeing Survey - Australia (PDF 9.1MB)

2021 Adult Financial Wellbeing Survey - Australia - Accessible (PDF 4.2MB)

2021 Adult Financial Wellbeing Survey - New Zealand (PDF 9.2MB)

2021 Adult Financial Wellbeing Survey - New Zealand - Accessible (PDF 4.5MB)

The ANZ Roy Morgan Financial Wellbeing Indicator is an ongoing time-series measure of financial wellbeing.

Powered by the Roy Morgan Single Source Survey, the ANZ Roy Morgan Financial Wellbeing Indicator provides unique, regular insights into Australians’ and New Zealanders’ financial wellbeing.

ANZ Roy Morgan Financial Wellbeing Indicator - March 2024 (PDF 364KB)

ANZ Roy Morgan Financial Wellbeing Indicator - September 2022 (PDF)

A matched savings and financial education program, Saver Plus provides an opportunity to have every dollar saved (up to $500) matched for your family’s education-related expenses.

A flexible education program for adults seeking to build money management skills, knowledge and confidence.

MoneyBusiness was developed to build the money management skills and confidence of Indigenous Australians living in remote communities.

ANZ’s latest Financial Wellbeing survey of adults in Australian reflects new ways of understanding and measuring financial wellbeing.

ANZ’s latest Financial Wellbeing survey of adults in New Zealand reflects new ways of understanding and measuring financial wellbeing.

Check out the Financial Wellbeing hub and calculate your Financial Wellbeing score.

This report provides detailed information on ANZ’s Environment, Social and Governance (ESG) performance and challenges.

1. From a baseline of approximately 2.4 million customers as at 30 September 2023.

2. Saver Plus.

3. Eight out of 10 months saving (as per Saver Plus program), measured by participant survey data.