Adapting

Read storyGrowing business during a crisis

Read moreCOVID-19 has had a profound impact on all our lives. Whether it is the devastating loss of lives, the crippling of some businesses and impact on livelihoods, limitations placed on social activities and the way we are working – 2020 will be remembered for generations.

Read moreWe could never have forecast 2020, a year that started with devastating bushfires in Australia and was followed by waves of a terrible, global pandemic that continues to spread. We still cannot predict its course but we do remain confident we can deal with its impacts.

By transforming our business - embedding a purpose and values-led culture and simplifying our products and services - we aim to create long-term value for all of our stakeholders.

Our value creation model outlines how we create value for our key stakeholders through our business activities, and identifies the inputs – or value drivers – that we rely on to enable us to deliver that value and meet our strategic objectives.

scrollThe risks and opportunities in our operating environment impact our ability to create value.

Trusted relationships with over 8.5 million retail, business and Institutional customers.

Access to capital through customer deposits, debt and equity investors and wholesale markets enables us to run our operations and execute our strategy.

Employees and contractors with the key competencies and right behaviours to deliver our strategy.

Reducing the risk of doing business for our customers and the bank, with systems and processes that are less complex, less prone to error and more secure.

Flexible, digital-ready infrastructure to provide great customer experience, agility, scale and control.

Strong stakeholder relationships are essential to our brand and reputation.

Operating across 33 markets, we provide banking and financial products and services to individual and business customers.

Through our business activities we deliver the following output:

Deliver decent returns enabling shareholders to meet goals

Improve the financial wellbeing of our customers

Provide funding for lending, helping customers to own homes and start and grow businesses and assist businesses to transact, trade and invest across our region.

Great customer experience through flexible and resilient digital infrastructure

Build a resilient, adaptable and inclusive workforce with a strong sense of purpose and ethics

Connect with, and invest in, the communities in which we operate to support growth, deliver services and develop opportunity

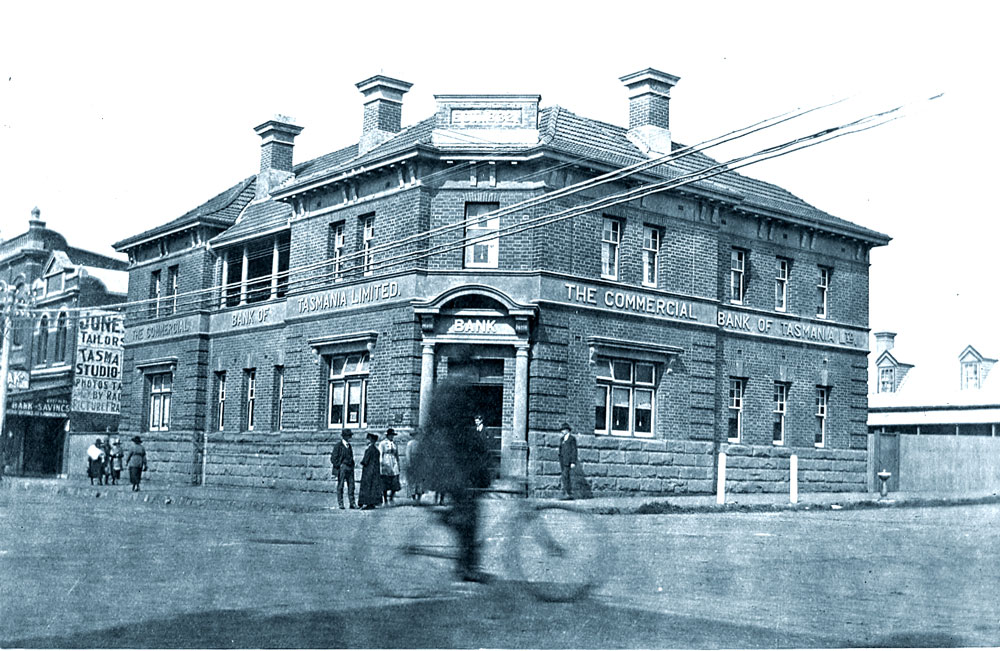

On 1 October 1970, in what was then the largest merger in Australian banking history, ANZ Bank Ltd merged with the English, Scottish and Australian Bank Limited to form Australia and New Zealand Banking Group Limited – the modern ANZ

scrollThe Bank of Australasia opens in Sydney

Bank of Australasia employs its first female typist, believed to be the first woman employed by an Australian bank. Mary Switte was appointed to the position of 'lady typewriter'.

In London, the Bank of Australasia merges with the Union Bank of Australia to form ANZ Bank Limited.

ANZ Bank Limited merges with the English, Scottish and Australian Bank to become Australia and New Zealand Banking Group Limited.

anz.com launches, followed closely by phone banking and internet banking.

ANZ Bank Limited acquires National Bank of New Zealand from Lloyds TSB.

ANZ is the first bank in Australia to offer customers a mobile-to-mobile payment application.

National Bank of New Zealand integrates into the ANZ brand.

With the launch of Apple Pay and Android Pay, ANZ customers in Australia now able to make tap and go payments wherever contactless payments accepted.

ANZ launches an unprecedented support package for small business and home loan customers with the potential to inject $6 billion into the Australian economy and assist in the recovery from the COVID-19 crisis.

To read full article, click here

Read storyGrowing business during a crisis

Read storyBanking through times of change

Read storyOpportunities arise in challenging times

Read storyBuilding financial wellbeing in the Pacific

Read storySupporting Wesfarmers to transition to net zero emissions

Read storyNew Zealand’s agribusinesses leading the way on transition planning

You can pick parts of the 2020 ANZ Annual Report that interest you the most and create a tailored document to suit your specific needs.