-

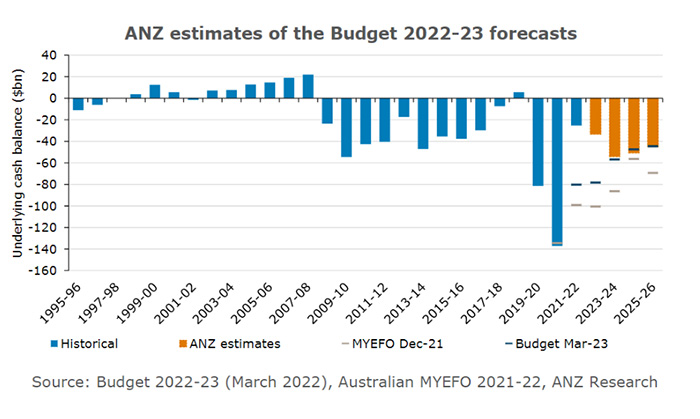

ANZ Research has updated its forecasts for the Australian Federal Budget, on the back of expected increases in both revenue and expenses from 2022-23 to 2025.26.

Australia’s Treasurer Jim Chalmers has suggested windfalls in revenue, including higher commodity prices, will be “nowhere near enough” to offset structural expense pressures from five critical areas – namely health, aged care, the NDIS, defence and interest payments.

Chalmers also said recent floods will have “a substantial impact on the budget”, which ANZ Research expects will be around $A3 billion, concentrated in 2022-23.

The government is putting “maximum effort into trimming spending”, according to the Treasurer. There will be more than $A20 billion in savings from cuts to previous policies. ANZ Research will be looking out to see how these funds are reallocated for new policies. This will help minimise the impact to the bottom line.

Over the longer term, persistent structural pressures will weigh on the budget and keep overall payments elevated, at around 26 per cent to 27 per cent of GDP.

Interest payments are expected to grow 14 per cent annually over the forward estimates, adding about $A13 billion to the bottom line.

Spending on NDIS, hospitals, aged care and defence is expected to grow each year by 12.1 per cent, 6.1 per cent, 5 per cent and 4.4 per cent respectively. The Treasurer has described these costs as “desirable or unavoidable or both”.

ANZ Research is not expecting a stream of new policy measures on budget night, with the government placing a “premium on affordable, responsible, sustainable spending”, the Treasurer has said.

Recent policy announcements have all had a clear productivity focus. Notably, paid parental leave will be extended to 26 weeks, with two additional weeks each year from July 2024. This means the scheme will not impact the budget until the later years of the forward estimates.

Conservative

The latest commentary from Chalmers has led ANZ Research to expect a conservative forecast of revenue in the budget.

Expect to see higher unemployment forecasts and an upgrade of inflation. These measures are expected to broadly offset each other and have kept ANZ Research’s view of income tax revenue broadly consistent with the budget preview from earlier in October.

Treasury estimated unemployment would rise from 3.75 per cent in 2022-23 to 4.25 per cent in 2024-25 in July.

ANZ Research had already built in a pessimistic Treasury view of commodity prices into revenue forecasts, but has upgraded that view a touch as a result of the lower $A and stronger path of commodity prices compared to Treasury expectations in recent months. A modest pipeline of new mining investment will reduce tax deductions for mining profits.

The regions

While it won’t hit the underlying cash deficit, the Treasurer has also mentioned there will be “big investments in the regions”.

Already, $A9.6 billion in infrastructure funding has been announced. Key projects include the Western Australian Electric bus network, upgrades to the Queensland Bruce Highway and the NSW Western Sydney Road package.

The Australian Government will also provide $A1.5 billion concessional funding to support fast tracking Victorian Renewable Energy Zones and offshore wind development.

This budget will also include a ‘wellbeing budget’, though the significance of this on the underlying cash deficit is unclear at this stage.

Madeline Dunk is an Economist & Adelaide Timbrell is a Senior Economist at ANZ

Receive insights direct to your inbox |

Related articles

-

Market and industry updates, emerging trends and global activity around sustainable and green loans, bonds and linked loans, and transition finance.

2022-10-20 03:00 -

Structural pressures and a slowdown in growth are expected to keep Australia’s budget in deficit.

2022-10-06 00:00 -

Asia may be approaching peak inflation – but will that be enough to stop the region’s central banks?

2022-09-06 00:00

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.